PHEV vs. Hybrid: Who Will Win

The automotive market, with over 90 million vehicles sold globally in 2023, plays a key role in transport and impacting emissions. Sustainability efforts are accelerating, with BEVs leading the shift through zero tailpipe emissions and over 10 million sales in 2023. Their rise is driving advancements in batteries, motors, and critical materials. Yet, amidst this BEV dominance, is there room for alternatives like plug-in hybrids?

IDTechEx projects the electric car market to grow significantly, reaching $2.83 trillion by 2045. This includes various segments such as plug-in hybrid electric vehicles (PHEVs), BEVs, and fuel cell EVs, highlighting their increasing share in the automobile industry market.

To better understand this growth in the electric vehicle market, it is essential to examine the leading industry trends and market outlook. These developments are heavily influenced by innovations in design and engineering, which drive improvements in vehicle efficiency, performance, and sustainability.

-

Market performance

The European EV market is experiencing slow growth, partly due to economic challenges in Germany, its largest market. In contrast, China leads as the largest EV market. Meanwhile, in the US, the rise of electric pickups reflects a growing focus on product design and development to capture the economic value seen in the conventional pickup segment.

-

Tech trends

EV technology relies on three core components: Li-ion batteries, traction motors, and power electronics. Among batteries, lithium iron phosphate (LFP) has regained popularity, especially in China's low-cost EV market, due to innovations improving energy density and affordability. In contrast, nickel-manganese-cobalt (NMC) batteries, valued for high energy density, face supply chain challenges and higher costs.

The global cathode market reflects these shifts, with LFP gaining share since 2019, while NMC evolves toward higher nickel content across regions. Rigorous testing, such as power cycling and thermal cycling tests, ensures the durability and reliability of these evolving battery technologies in various applications.

-

Developments in regulations

The electric car market has been driven by consumer demand and government incentives, primarily benefiting luxury EVs outside China. However, this is changing, especially in Europe, as subsidies give way to strict CO2 regulations. Manufacturers face rising zero-emission sales targets to avoid hefty fines, with major EU deadlines in 2025, 2030, and a full internal combustion engine (ICE) ban by 2035.

While some manufacturers oppose these rules, others comply, anticipating a surge in EV sales to meet targets.

In the U.S., Environmental Protection Agency (EPA) and California Air Resources Board (CARB) regulations are expected to boost EV adoption in the second-largest car market. Meanwhile, China, with its recognized manufacturing excellence, leads globally, potentially reaching 50% of new car sales of “New Energy Vehicles”, including PHEVs and BEVs, in 2024, surpassing government expectations. Unlike other regions, China treats PHEVs and BEVs equally in subsidies, further driving their popularity.

A look at PHEVs

A PHEV combines a traditional ICE with an electric motor and a rechargeable battery. Unlike conventional hybrids, PHEVs can be plugged into an outlet to charge the battery, enabling short trips using only electric power. When the battery runs out of charge, the vehicle transitions to using its gasoline engine. This dual-power system offers greater flexibility and reduces fuel consumption, making PHEVs a popular choice.

According to Statista, PHEV sales have more than doubled since 2019, with projections indicating continued growth through 2028.

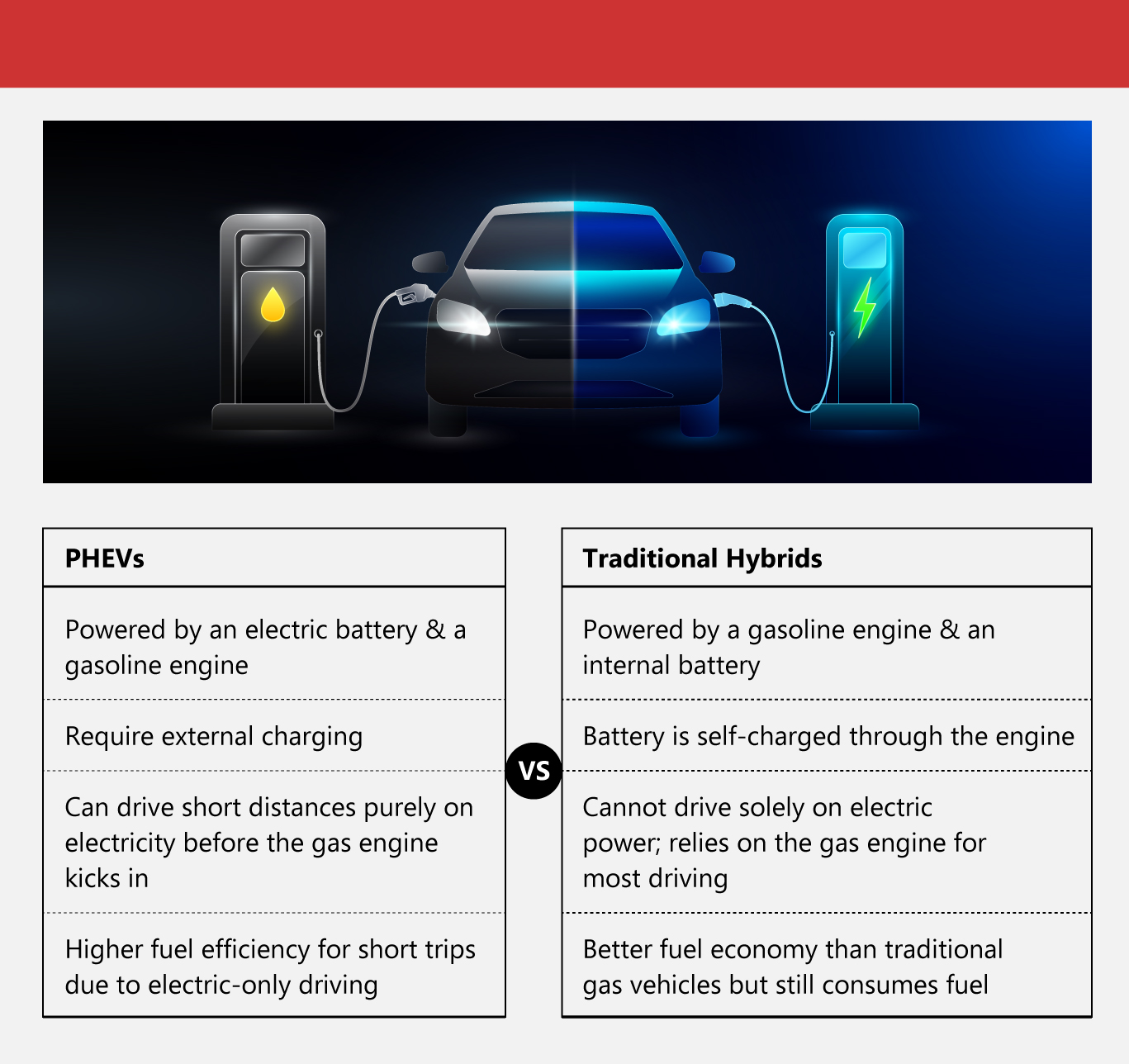

PHEVs vs. Hybrids

The key distinction between hybrid and PHEVs is that the latter can operate solely on electric power for short trips, allowing drivers to charge overnight and potentially complete their daily commute without using any gasoline. In contrast, traditional hybrids are more fuel-efficient than gasoline vehicles but still rely on gas for all driving distances.

PHEVs strike a balance between traditional gas-powered cars and fully electric vehicles. They primarily run on electric power, which is charged through an onboard cable. Once the battery runs out, the car switches to gasoline, allowing you to reduce gas usage during daily trips and rely on it when needed.

For those interested in the experience of owning an EV, a plug-in hybrid offers a more gradual introduction to the transition, without fully committing to an all-electric lifestyle. It is ideal for drivers who prioritize daily efficiency but require the flexibility to travel long distances with minimal downtime.

While EV charging infrastructure and times are continuously improving, a PHEV may still provide a more convenient option for the time being, thanks to its reliance on electric and gasoline power.

Meanwhile, drivers opting for hybrid vehicles seek a balance of efficiency and ease of use. By integrating an ICE with a large battery, traditional hybrids enhance fuel economy and help reduce overall fuel consumption.

A traditional hybrid offers a similar experience to owning a conventional gas-powered car. There's no need to worry about charging, as the vehicle relies solely on fuel and doesn't require plugging in. This makes traditional hybrids an ideal option for drivers without access to a garage or those who prefer not to depend on public charging stations.

Benefits of PHEVs

While flexibility is a key advantage, PHEVs offer several other benefits for drivers seeking to balance environmental impact, fuel efficiency, and convenience.

-

Reduced fuel consumption

PHEVs allow for electric-only driving on short trips, reducing reliance on gasoline and cutting fuel costs significantly.

-

Lower emissions

By using electric power for daily driving, PHEVs contribute to lower emissions compared to traditional gas-powered vehicles.

-

Government incentives

Many regions offer tax credits and incentives for purchasing PHEVs, which can make them more affordable.

-

Reduced dependency on charging stations

Unlike fully electric vehicles, PHEVs don’t rely on charging stations for daily use, offering convenience for drivers without home charging setups.

-

Regenerative braking

PHEVs recover energy through regenerative braking, which helps extend battery life and improve overall efficiency.

-

Transition to electric driving

PHEVs provide an excellent stepping stone for those considering fully electric vehicles but not yet ready for full adoption.

Despite their numerous benefits, PHEVs face challenges that cannot be overlooked. Limited all-electric range, reliance on gasoline for extended travel, and higher upfront costs compared to traditional hybrids or some EVs are notable drawbacks. However, their blend of electric and gasoline power continues to make PHEVs a viable option in the EV revolution, bridging the gap as industrial manufacturing evolves to support broader electrification. As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog