PH EV Industry Gains Momentum This 2025

The adoption of electric mobility in the Philippines has gained momentum since the Electric Vehicle Industry Development Act (EVIDA), which took effect in May 2022. With strong government backing and continued private sector initiatives, the country’s transition toward sustainability in the transport sector is expected to accelerate further.

Data on the Philippine automotive market reveals both hurdles and growth prospects for electric vehicles (EVs). In 2023, EV sales surpassed 11,000, with hybrid electric vehicles (HEVs) making up over 9,000. Compared to 2022’s sales of around 1,000 units, the market experienced a tenfold surge within just one year.

The current state of the PH’s EV market

Despite strong sales growth, EVs accounted for only 2% of the automobile industry market shares in 2023. Department of Energy (DOE) Undersecretary Wimpy Fuentebella noted that figures are underestimated, as light EVs are exempt from Land Transportation Office (LTO) registration. According to the DOE, EV companies reported nearly 20,000 units sold in 2023, yet Land Transportation Office (LTO) records reflected only 7,515.

The agency is collaborating with key government bodies, including LTO and the Department of Trade and Industry (DTI), to bridge the discrepancy.

Although current figures fall well short of the DOE’s target of 2.45 million EV units by 2028, the industrial market remains hopeful. Stakeholders believe this goal is within reach, driven by increasing investments, lower battery costs, and government incentives.

Targeting market expansion

China, Europe, and the US have more advanced EV markets, with growth possibly slowing in the coming years. In contrast, Southeast Asia is still in the early adoption phase, navigating challenges as it works toward becoming a future-ready EV market.

Experts speculate that Chinese manufacturers may remain dominant in the EV sector across Southeast Asia. China's strong position is supported by its strategic location and well-established supply chain management, ensuring efficient trade and distribution in the region.

Moreover, Chinese EVs offer strong economic value, with affordable pricing and extensive manufacturing expertise acquired from serving both domestic and international markets. Their cost-effective production and strategic pricing make them attractive to budget-conscious countries like the Philippines.

Despite increasing sales, growth in the region still faces significant challenges, mainly due to limitations in charging infrastructure as opposed to vehicle availability.

The push for better EV infrastructure

Nevertheless, DOE stated that the Philippines is making steady progress toward its 2024 target for EV charging stations.

Fuentebella noted that the government plans to install an additional 100 stations annually. At present, more than 800 charging points are available across 120 locations nationwide, reflecting positive environmental indicators for sustainable transportation.

Here are some steps the public and private sectors are taking to expand EV infrastructure in the country:

-

Gas Stations to Add EV Charging

Currently, DOE is drafting new regulations requiring gasoline stations to incorporate EV charging infrastructure, as mandated by EVIDA. If enacted, fuel stations may be obligated to install, operate, or maintain commercial EV chargers on-site.

Aquino explained that the required number of EV charging units will be determined by the size of each gasoline station. He suggested that stations with more than four fuel pumps may need to install at least one charging unit, while smaller stations with only a single pump might be exempt. DOE plans to collaborate with industry stakeholders to establish fair and practical guidelines.

-

Launch of the Revised EV Industry Roadmap

DOE plans to roll out the revised Comprehensive Roadmap for the Electric Vehicle Industry (CREVI) this month. Meanwhile, the proposed Electric Vehicle Incentives Scheme (EVIS) is expected to be submitted to the Office of the President by year-end.

Edmund Araga, president of the Electric Vehicle Association of the Philippines (EVAP), stated EVIS is making steady progress, with DTI planning to hold a key consultation.

-

Extended tax breaks

The Philippines has extended its duty-free policy for electric vehicles until 2028, expanding its scope to include hybrids, electric motorcycles, and e-bikes. Initially launched in 2023 under President Ferdinand Marcos Jr., the tax break aims to boost industrial manufacturing and encourage greener transportation.

This policy, now aligned with the president’s term, was first introduced in 2022 to cover EVs, buses, vans, trucks, and related parts. By making EVs more accessible, the government hopes to drive sustainability and strengthen the nation’s industrial sector.

Challenges in EV adoption

Despite growing support for EVs, several hurdles still hinder widespread adoption.

-

Insufficient charging stations

Despite government support, EV adoption in the Philippines remains difficult. A major issue is the shortage of charging stations, especially outside big cities. Even in urban areas, reliable charging points are scarce, fueling range anxiety. Adding to concerns, the national power grid’s stability is uncertain, raising doubts about sustaining large-scale EV charging year-round.

-

High cost

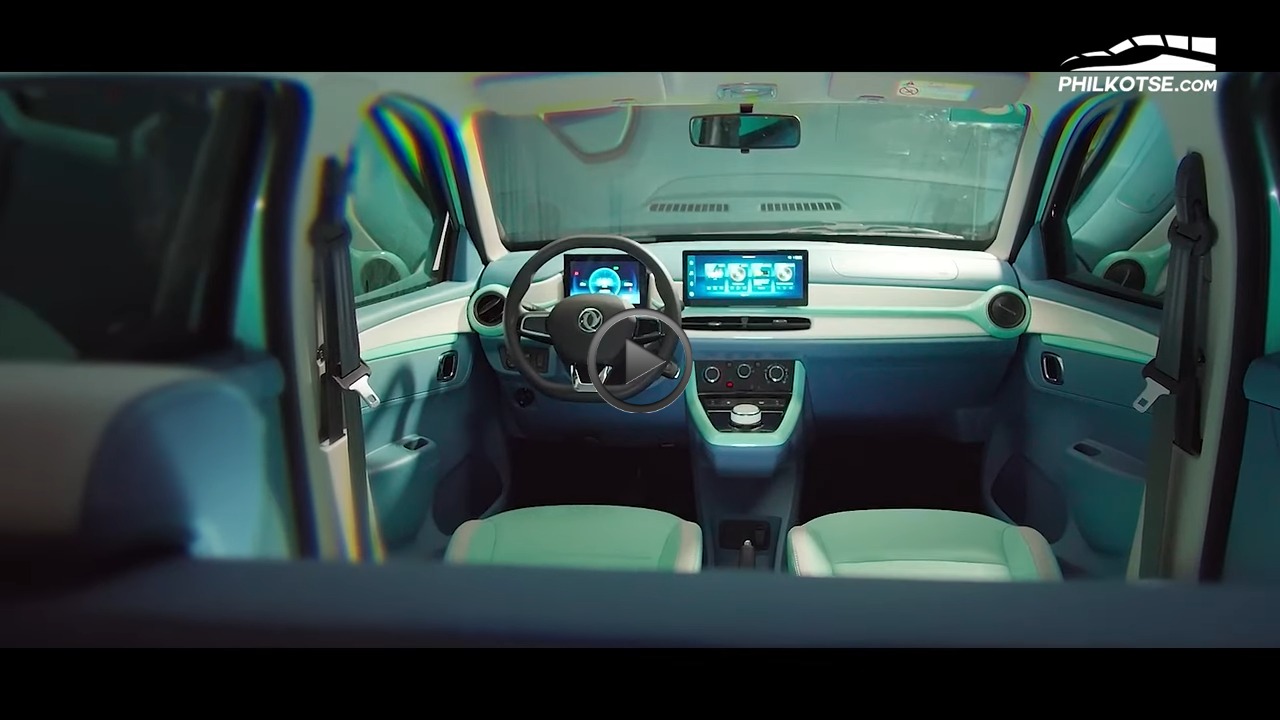

High EV prices hinder adoption in the Philippines, where buyers prioritize affordability even among vehicles and automotive parts suppliers. Limited model variety further restricts options. Tesla’s entry excites premium buyers but remains costly and lacks a strong service network. Meanwhile, Chinese brands like BYD and MG offer budget-friendly EVs, attracting consumers.

-

Market fluctuations

Beyond infrastructure and pricing, global market dynamics impact EV adoption. While fuel prices have stayed steady, the peso’s decline against the dollar raises concerns. A fuel price hike or further currency weakening could push consumers toward fuel-efficient or alternative energy vehicles. Many Filipino households prioritize fuel savings, especially during uncertain economic times.

-

Consumer awareness

Buyer awareness is another challenge. Despite car companies’ efforts, many Filipinos lack knowledge of EV options. Confusion persists between hybrids, plug-in hybrids, and full EVs. Concerns over battery life, durability, and maintenance costs remain, especially for Chinese brands. Improved product design and development could help build trust and drive adoption. Expanding EV infrastructure in the Philippines is crucial for greater adoption. Investing in charging stations, improving grid reliability, and fostering public awareness can ease consumer concerns. Collaboration between the government and private sector will accelerate progress, making EVs more accessible, practical, and sustainable for a growing number of Filipino drivers.

Expanding EV infrastructure in the Philippines is crucial for greater adoption. Investing in charging stations, improving grid reliability, and fostering public awareness can ease consumer concerns. Collaboration between the government and private sector will accelerate progress, making EVs more accessible, practical, and sustainable for a growing number of Filipino drivers. As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog