Contactless Payment and The New Normal

The global pandemic has changed the way we make transactions, and along with this, how we view physical currency. With the rise in contactless payment options, will cash become a thing of the past?

In such a short time, contactless payment has changed the way we transact and pay for things. It was one of the game changers during the height of the global pandemic, shifting consumers’ behaviors in response to ever-increasing concerns surrounding safety and hygiene. Many businesses refused to accept cash during this time, and there was growing anxiety over transmitting the virus through something as simple as paying for groceries with physical money.

(Also read: COVID-19 Fuels Demand for Touchless Technology)

Today, contactless payments are quickly becoming the norm in how we pay for our purchases, despite the relaxed social distancing restrictions. Many people have grown quite used to transacting this way, and it’s very easy to see why.

Many find it cumbersome, and not to mention unsafe, carrying around a lot of cash in their wallets. For some, the difficulty in locating an ATM when the need arises has become a bother. After the pandemic, those who have debit cards no longer feel safe manually keying in their PINs or touching screens to pay for purchases.

There are numerous reasons why we have adapted so quickly to contactless payment, but here’s one simple reason that rises above the rest: contactless payment is easy and convenient. Just tap and go, and you’re done.

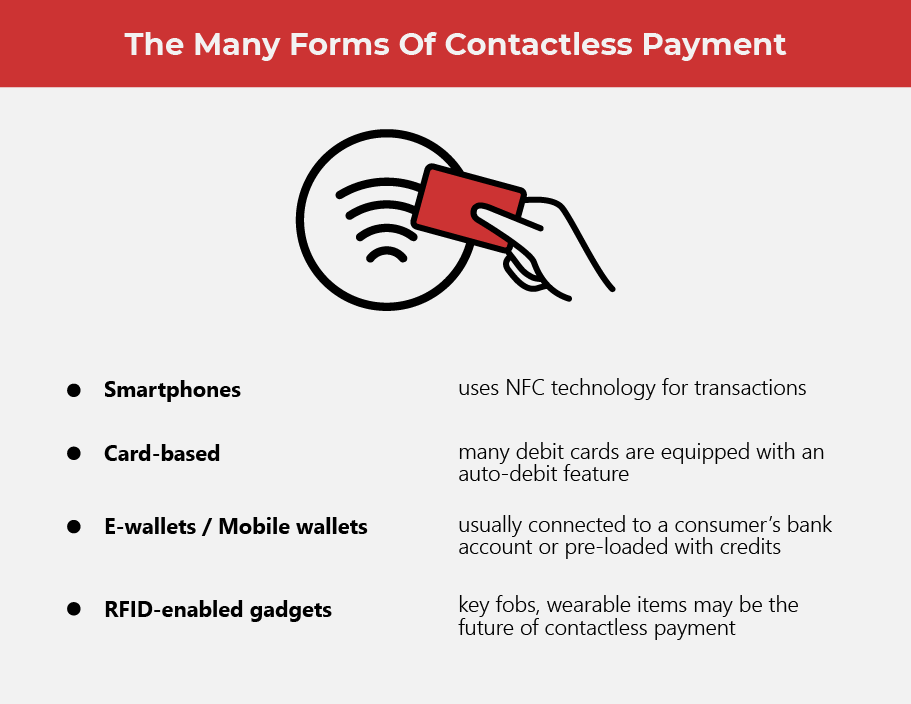

So Many Options, No Contact Required

Those in the payment industry have pointed out that we are currently using two predominant modes of contactless payment. The first is our smartphones, and the second is our credit/debit cards that come equipped with contactless payment features.

Through the use of NFC (near frequency communication) technology, we can pay for purchases directly through our smartphones simply by “tapping and going”. Thanks to peer-to-peer technology, our smartphones can directly interact with payment terminals to quickly make the transaction. Another way our smartphones are used for contactless payment is through the use of mobile wallets. Scanning QR codes has become a very popular and convenient method for customers to send payments to merchants without even reaching for their physical wallets.

On the other hand, credit and debit cards are also stepping up their game to keep up with the contact payment trend. These have also played a role in keeping businesses afloat during the pandemic, encouraging and supporting social distancing, as well as keeping the economy going. According to the banking and finance industry organization, Giesecke + Devrient, there were 721 contactless card transactions in 2020, a 12.5% increase from 642 million from the same month of the previous year.

Credit card giants Visa and Mastercard have added new technology to their cards. Apart from the EMV chips installed, these companies have incorporated biometrics such as fingerprint identification for in-store purchases.

Meanwhile, other companies are quickly following and making their own innovations. Apple Pay has added facial recognition, or Face ID along with its Touch ID to make payments easier and also more secure.

The Pros and Cons of Contactless Payment

The ease and convenience that contactless payment options present for consumers is the biggest thing it has going for it. It’s quick, easy, and automatic. On the merchants’ side of things, tapping and going means faster transactions and quicker checkout times. According to EastWest Bank, contactless transactions only take up as little as ten to fifteen seconds, while those made with cards can take up to about forty-five seconds.

Consumers feel safe using contactless payment when making purchases because it removes having to carry around large amounts of money. And, in cases of loss or theft, there can be some peace of mind knowing that money is kept safe and is inaccessible to thieves.

Technology has come a long way in that transactions made through contactless payment are safe and reliable, which boosts people’s confidence in using this method more and more to pay for smaller, everyday purchases.

When it comes to the downside, the same technology that makes contactless payment great can also be its downfall. Though rare, there can be glitches where systems can make mistakes, especially when making online purchases with the use of debit cards. This can become frustrating to consumers who were only looking to make transactions more convenient.

There are also lower transaction limits connected to contactless payment options. There can be a cap or a limit to how much a person can spend using their chosen method. And though contactless payment is very much widespread in Asian countries such as China and Korea, it’s still not very widely accepted in other parts of the world.

The Future is Contactless

It’s astonishing when we notice how quickly we have embraced contactless payment in our daily lives. Think about the last time you have had to count for change to pay for a cup of coffee, or even to purchase something very quickly at a convenience store. The mere thought of trying to locate the nearest ATM might make a lot groan out of frustration.

Many businesses have chosen to adapt numerous contactless payment options for their establishments, and those who do not may suffer from being left behind. EastWest Bank reports that younger business owners have been quicker in adapting to these changes than their older counterparts. The bank says that 41% of millennial small business owners have started accepting fewer cash payments as compared to 31% of Gen X business owners and 21% of Boomers.

With more and more consumers being wary of handling physical money and many who would prefer using contactless payments over cash, it won’t be surprising for more contactless payment options to crop up very soon, making handing over our hard-earned money easier than ever.

As one of the Top 21 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog