Powering the EV Arms Race

The rise of EVs has put a lot of pressure on battery manufacturers all over the globe. In the effort to create greener solutions, what challenges do these manufacturers face, and what are the costs of coming out on top?

As governments all over the globe push for more initiatives to reduce harmful carbon emissions and slow down global warming, car companies are doing their part to ensure greener vehicles take over petrol-powered cars. The rise of EVs in the last few years is a testament to this effort, but the shift is proving to be a delicate and precarious one with its own set of ethical and environmental challenges.

BloombergNEF says that with the exclusion of hybrid EVs, passenger EV sales are expected to increase from 3.3 million in 2021 to 66 million in 2040. Meanwhile, a survey from Ernst & Young shows that the number of consumers looking to purchase EVs increased by 11% in 2021 compared to those in 2020.

(Also read: Shifting Gears to EV: OEM’s Next Challenge)

With the enormous demand for EV production comes an even larger one for the batteries that power EVs. Lithium-ion batteries are what power most of the EVs and PHEVs today. Ensuring a steady, reliable, and cost-effective supply chain for the production of these batteries while balancing other environmental and ethical considerations is the challenge battery manufacturers have to face.

Leading the Batt Pack

It would be impossible to discuss EVs without breathing a word about Tesla. With OEMs following Tesla’s paths to innovation and adopting a few of its strategies, it has become a trendsetter in the EV industry.

When its founder Elon Musk announced plans of building “gigafactories” for battery production, battery manufacturing companies followed suit with the construction of their own “megafactories”. Giants of the battery industry such as LG Energy Solution and Samsung SDI looked to the expansion of their battery plants, a trend that sparked the battery arms race.

Experts recognize that it’s a trend that can only grow in magnitude at a breathtaking pace. Not only are the biggest names in the auto industry such as Audi and Mercedes Benz claiming their piece of the pie, but tech companies such as Apple and Google are also looking into carving their niche within the battery-making space as well.

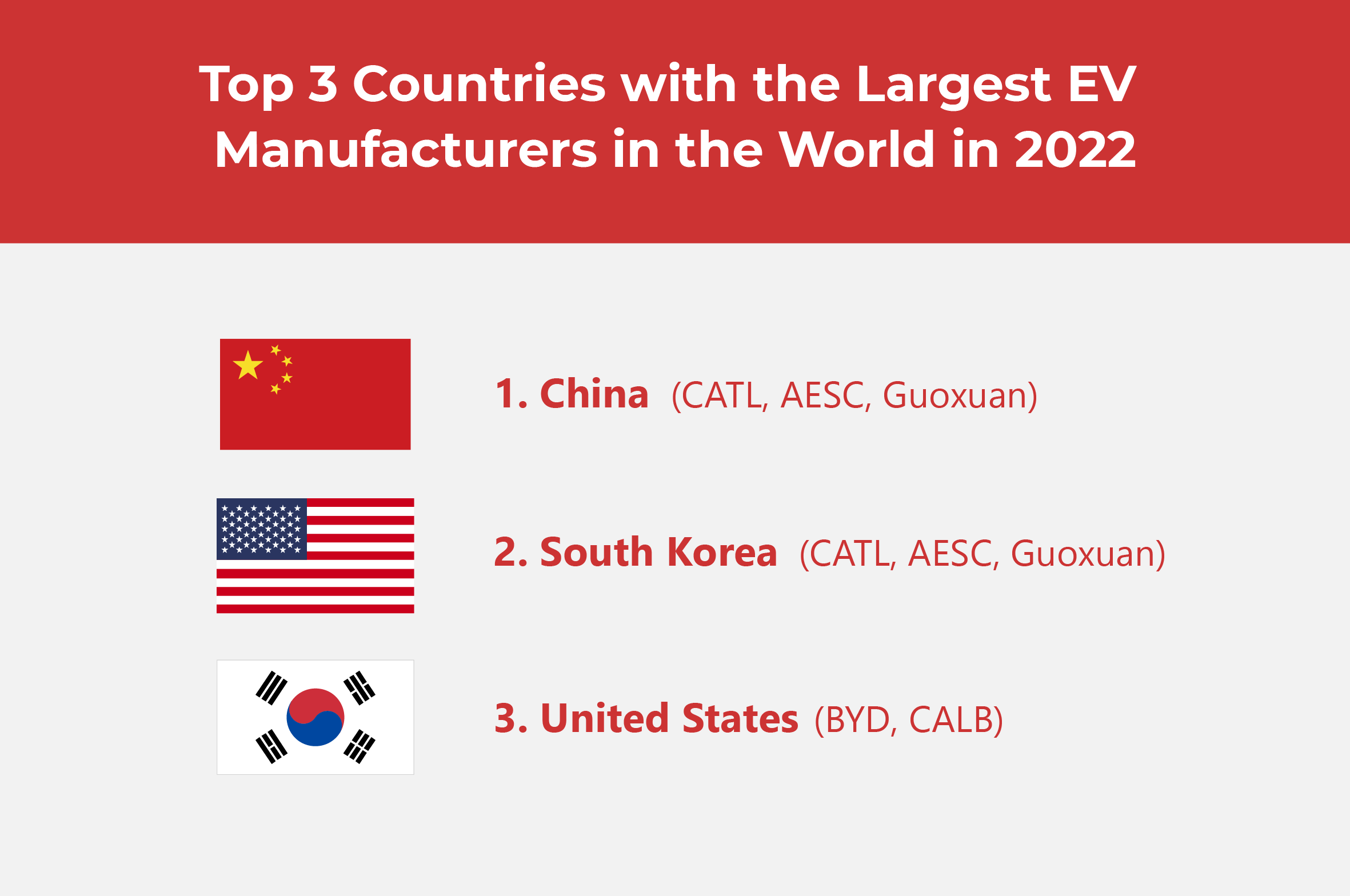

It isn’t surprising for a country like China to lead the battery arms race today. The country has the largest market for EVs, with a total sale of over a million vehicles in 2021, accounting for 40% of global sales. And, according to Elon Musk, Tesla’s Shanghai factory is now producing more cars than its California counterpart.

Batts at what cost?

Ethical and environmental concerns add to the challenges of these demands. Mining for minerals essential in the creation of the batteries that power the EVs, minerals such as cobalt and nickel, for example, is a large and pressing concern that battery manufacturers and the OEMs themselves have to take more seriously.

With China dominating battery manufacturing, the country’s firms in charge of mining operations in mineral-rich countries such as the Democratic Republic of Congo (DRC) have been in the spotlight for the way they treat cobalt miners. This mistreatment has already caught the attention of organizations such as Amnesty International, and RAID, a corporate watchdog agency based in the United Kingdom.

Anneke Van Woudenberg, RAID’s director says, “Cobalt is an essential mineral for the green transition, but we must not turn away from the abusive labor conditions that taint the lithium-ion batteries needed for millions of electric vehicles.”

In the effort to create greener vehicles, there are labor issues that plague the battery supply chain.

The battery arms race has created labor problems stemming from subcontractualization. While most major battery manufacturers are careful to ensure fair treatment for employees, these same companies also rely on subcontractors to hire manpower working in cobalt mines. And many of these subcontractors mistreat miners.

On top of this, COVID has also made working conditions much harsher for many of the miners from DRC.

As a response to this, Tesla has now been looking for alternatives to cobalt, such as nickel. However, this also comes with its own set of problems, the least of which is related to the degradation of the environment caused by the mining of nickel, as well as surging prices of the mineral because of the sudden spike in its demand.

Building Better Batts

Amid the pressures and complexities of the battery arms race are startups whose innovations just may help pave a better way for making batteries for EVs. Companies such as SES, QuantumSafe, and Solid Power have their race to run—making batteries safer and more affordable.

These companies create batteries that use lithium metal anodes, much-sought-after in the battery industry because these produce lightweight cells that power EVs with longer driving ranges.

Bloomberg reported that SES has announced that it has successfully developed the world’s largest lithium-metal cell, expecting commercial roll-out by 2025. The company’s success is attributed to being able to make liquid metal anodes work well with liquid electrolytes.

Meanwhile, QuantumSafe and Solid Power are companies focused on using solid electrolytes, namely ceramic and lithium sulfide, respectively.

Bloomberg’s report concludes with an optimistic outlook for the battery industry, that for as long as innovators have more routes to achieving higher performing batteries, the better. All the better for us consumers, who can only benefit from having more efficient and less expensive batteries for the EVs that we eventually will be buying.

(Also read: Innovations in EV Batteries)

As one of the Top 21 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog