China & Mexico: A Win-Win Partnership?

Mexico is well-known for its factories producing global brands like Audi and BMW, in a market where Chinese cars were once viewed with skepticism. However, Chinese automakers are now making significant progress in the international automobile industry market shares, with companies like BYD surpassing Tesla. This is despite Tesla’s strong presence in China and its CEO Elon Musk's potential influence on U.S.-China auto policy due to his investments in an advisory role with the Trump administration.

Leveraging Mexico for Strategic Advantage

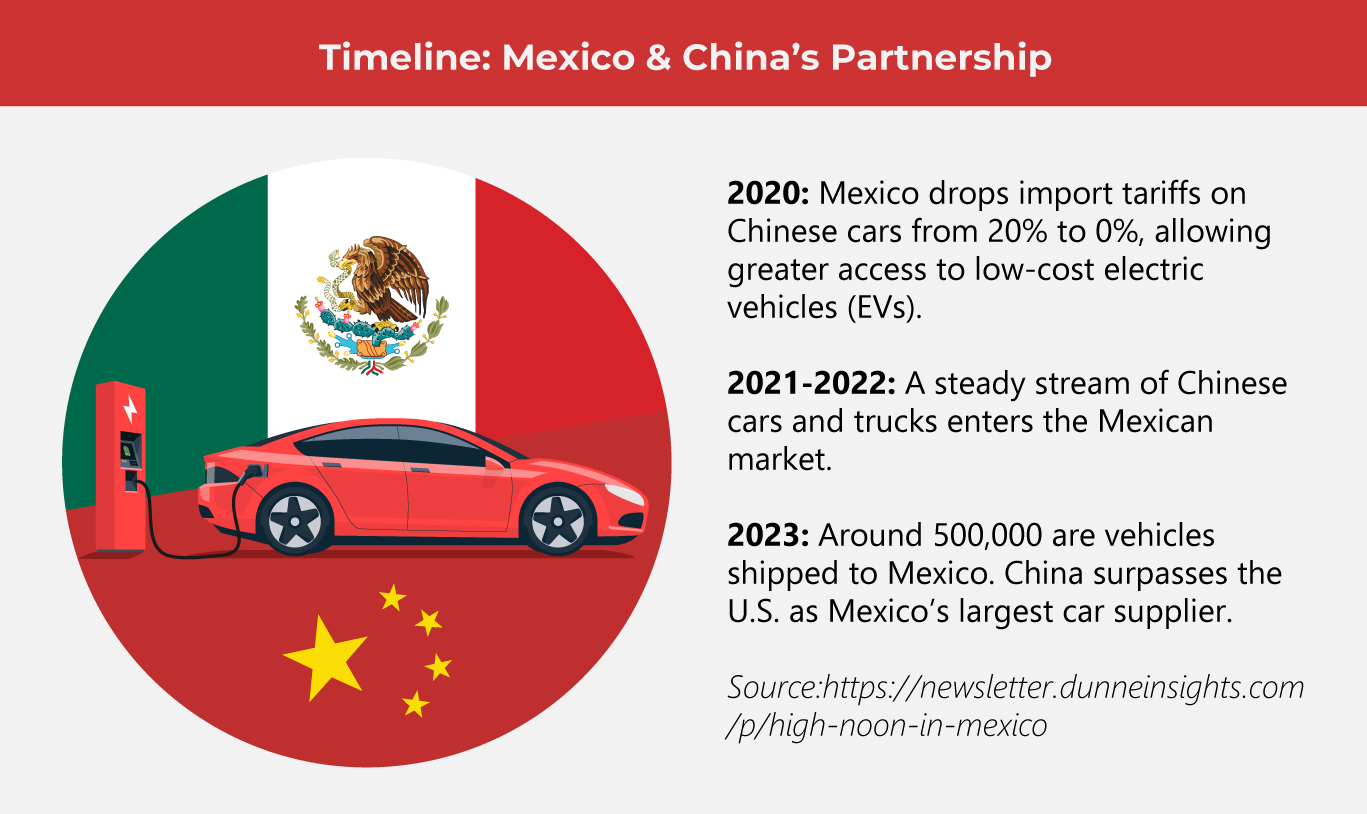

Mexico, with its manufacturing capabilities, has emerged as a pivotal market for Chinese car manufacturers, with China becoming the leading car supplier to the country, exporting $4.6 billion worth of vehicles in 2023. This growth is driven by China's focus on establishing a stronger presence in North America, particularly through electric vehicle (EV) manufacturers like BYD. These automakers are actively exploring factory locations in Mexican states such as Durango, Jalisco, and Nuevo Leon, highlighting Mexico's strategic role in their expansion plans.

For China, Mexico presents an attractive opportunity due to its proximity to the U.S. and its established role as a manufacturing hub. By investing in Mexico, Chinese carmakers can potentially circumvent trade restrictions that limit direct access to the U.S. market. This influx of foreign investment strengthens Mexico’s economic value and enhances its position in the global automobile industry.

Mexico's Role in the Automotive Manufacturing Industry

Mexico ranks as the world's seventh-largest vehicle manufacturer, with many leading carmakers, including Volkswagen, Ford, and General Motors, operating factories in the country. These automakers often rely on automotive parts suppliers from China, which manufactures components at a plant located near a major BMW factory close to San Luis Potosí.

According to the Mexican Automotive Industry Association, nearly 80% of the vehicles produced in Mexico are part of China’s outsourcing process and exported to the United States. Despite high tariffs on cars manufactured in China, Chinese-made vehicles produced in Mexico and exported to the U.S. would face a significantly lower tariff rate.

EVs represent less than 2% of new car sales in the country, but their growth has exceeded 40% in 2024, despite the limited availability of public charging stations. In Mexico City, these vehicles are exempt from restrictions placed on gasoline and diesel cars during high pollution days, supporting sustainability efforts and improving air quality.

Trump’s declaration on Mexican products

On November 7, just two days after the election, Trump made his displeasure known regarding Mexico's role in global manufacturing and its impact on U.S. interests. He warned that if Mexico did not address the flow of drugs and criminals into the United States, he would impose a 25% tariff on all goods imported from Mexico.

Trump's frustrations are shared by other global leaders. Doug Ford, the Premier of Ontario, Canada, expressed similar concerns, suggesting the possibility of removing Mexico from the USMCA (United States-Mexico-Canada Agreement).

Former President Biden has implemented policies to counter the growing challenge from China, including providing subsidies to support U.S. battery manufacturing. Meanwhile, the Chinese government has consistently backed its carmakers through subsidies, with the strategic aim of establishing China as a leading exporter in the global automotive market.

JAC Motors is currently the only Chinese automaker with an assembly plant in Mexico. The key development to watch is whether BYD will follow through with plans to build a factory in Mexico.

What’s happening now

Donald Trump's re-election has raised concerns about the future of Chinese carmakers exporting auto components to Mexico for assembly and re-export to the United States. With U.S. pressure on Mexico to limit Chinese automakers, Mexico's president, Claudia Sheinbaum, is likely to prioritize U.S. relations.

Last October, Mexico increased tariffs on imported cars from 15% to 20%, a move largely viewed as a response to the rising popularity of Chinese vehicles. This followed the first nine months of 2024, during which Mexico imported 353,416 fully manufactured vehicles from China, making it the second-largest importer of Chinese cars after Russia.

In 2023, Chinese car companies like BYD, JAC Group, and Geely sold 129,329 vehicles in Mexico, marking a 63% increase from the previous year, according to the National Institute of Statistics and Geography (INEGI) and the Mexican Association of Automotive Dealers (AMDA). The top-performing Chinese automobile brands in Mexico were Chery, SAIC Motor, and JAC Group.

Before Trump won, BYD announced its plans to invest $600 million in a new energy vehicle (NEV) plant in Mexico, targeting an annual capacity of 150,000. Volvo, under majority Chinese ownership, is investing $700 million in a truck plant in Monterrey in Mexico. Meanwhile, JAC Group has begun domestic production in partnership with Mexico's Giant Motors since 2017.

Recently, Elon Musk revealed plans to halt operations at the Monterrey factory, focusing instead on boosting production at the company’s facilities in California and Texas.

Alternatives to Mexico

Trade experts see significant growth potential in the South American market despite anticipated challenges in Mexico. Brazil has emerged as a key destination for China’s new energy vehicle (NEV) exports, alongside Belgium. BYD, Great Wall Motor, and Chery, have announced production initiatives in Brazil.

BYD is building manufacturing facilities in Bahia, aiming for an annual capacity of 150,000 units. These facilities will also process lithium and iron phosphate for the global electric vehicle market.

Chinese automakers have gained substantial market shares in regions with local production or minimal trade barriers. In Brazil, Chinese car brands now account for 9% of car sales, a sharp rise from just 1% in 2019. Similarly, in Thailand, their market share has grown from 5% in 2019 to 18%.

Will Mexico remain a top destination for Chinese car producers? With growing investments, local production, and strategic advantages, it seems likely—but shifting trade policies and geopolitical tensions could change the landscape. As the market evolves, the future of this partnership remains uncertain. Only time will tell.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog