The Chip Crunch: How It Affects Automakers

According to experts, the chip shortage situation has improved this year. Still, it's a long-term issue that the auto industry must prepare for by developing new sourcing strategies and working closely with original equipment manufacturers (OEMs) and suppliers.

When COVID-19 hit, the automotive industry also took a hit, with vehicle sales on a downtrend. But with the economy opening up and slowly recovering, a new problem is on the rise. With auto demand rising, carmakers are grappling with the chip shortage, urging OEMS to shut down manufacturing lines and eliminate add-on features like seat heaters from their product range.

When chip shortage was at its worst, vehicle production worldwide declined by more than 25% during the first three quarters of 2021.

Also read: This Chips War Is Just Getting Started

Why the auto industry is the hardest-hit

For a few years, semiconductor-dependent products have suffered from chip scarcity. During the pandemic, the rise of remote work and online transactions has triggered a huge demand for wireless technology and personal computers. According to McKinsey, the clamor for semiconductors in 2020 and 2021 across all sectors surpassed predictions made before the pandemic. This translates to heightened chip supply competition for vehicular OEMs and suppliers.

Here are the other reasons why the automotive industry is at the short of the stick:

- On-demand production

Many OEMs and suppliers request semiconductors and other auto parts near the production date to manage inventory expenses. When auto sales dropped during the start of the pandemic, suppliers and manufacturers reduced their chip orders, resulting in low stock just as demand started to rebound.

Consequently, some companies are forced to order 10% to 20% more semiconductors than they need to guarantee production. In 2022, OEMs and suppliers were forecast to order vehicular chips for 12 million fresh cars, even if experts predict vehicle sales to be over 80 million.

- Specialized products

Vehicle companies usually have intricate and customized output compared to other industries' products. Because of this, it's more challenging to gauge semiconductor requirements, resulting in varying demands.

- Strict safety standards

Vehicle companies observe stringent measures to ensure user safety. This requires them to utilize special chips that underwent rigorous certification. If such chips are low in supply because of a lack of raw materials, then the production schedule will be significantly impacted.

- Growing vehicular technology

The e-vehicle (EV) industry and autonomous driving and connectivity are on the rise. As demand for these products grows, vehicular components, including chips, must keep up to secure the market while paving the way for newer technologies.

Outlook for the chip shortage

The Russia-Ukraine conflict has escalated the supply chain issue since both countries provide semiconductor raw materials. Another problem is rising transport expenses, primarily via air. Also, because OEMs are hard-pressed for auto components, some have drastically decreased production output, reducing demand for semiconductor-dependent elements, further affecting the chip industry.

The good news is that chip stocks will become more secure in 2022. This is partly due to dropped sales of computers, mobile phones and personal electronics, allowing surplus chips to be allocated to other sectors that suffered during the pandemic. This helps stabilize global vehicle prizes. According to JP Morgan, this boosted chip supply will enable a maximum of 8% volume growth in passenger vehicles.

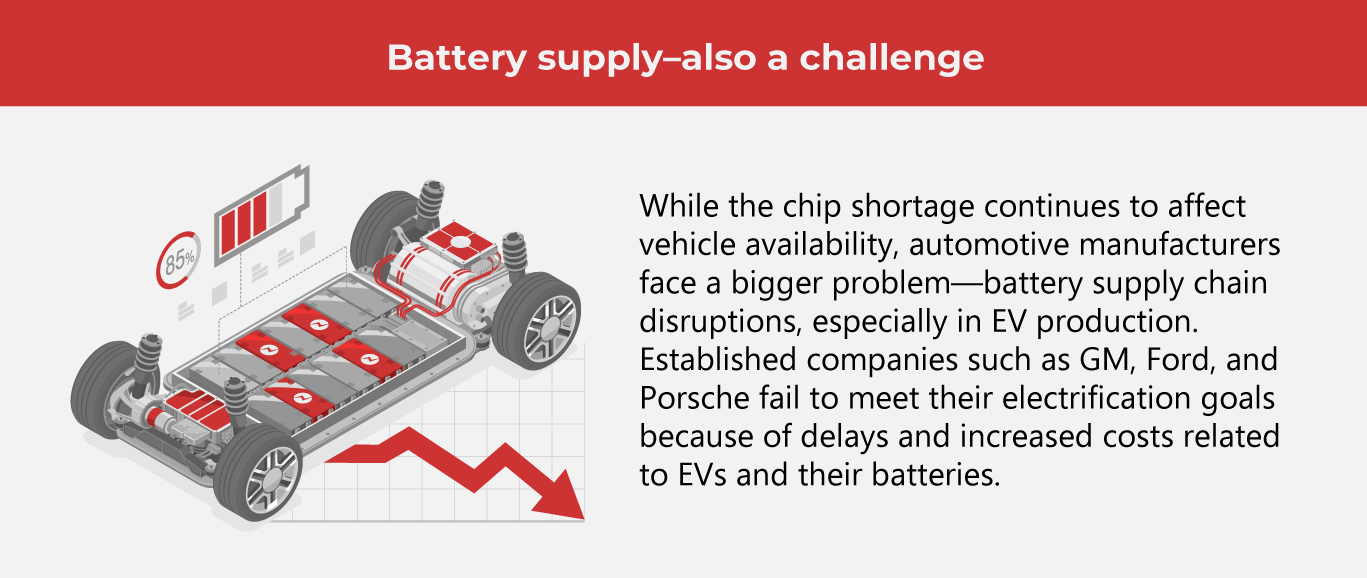

Still, automobile companies are progressively necessitating chips with enhanced processing capabilities, especially with the growing popularity of EVs and self-driving vehicles. These chips are radically different from those used in consumer electronics. To cope, auto companies are prioritizing their premium offerings to optimize earnings.

Uncertain chip inventory also continues to hinder companies' growth. For instance, Mumbai-based automotive manufacturer Mahindra & Mahindra is encountering challenges with its well-received Scorpio-N model. At the same time, Toyota has stopped reservations for a particular variant of its Hycross SUV because of supply problems.

What automakers can do

Even before the pandemic, the chip supply chain was already under pressure. However, recent developments such as the power shortage, natural calamities, and political instabilities have exacerbated the issue. With all these challenges, McKinsey predicts that the chip shortage will likely extend for three to five years. In the meantime, vehicle makers can take these steps to protect their assets.

- Using data to drive plans and processes

Planning processes need to be extensive, covering all production points. While OEMs and suppliers already use data to monitor products along the distribution network, sales teams can also conduct deeper statistical analyses to predict demand. AI and other digital tools can help businesses allot semiconductors to the proper areas to ensure sustainable production. Teams can also benefit from a risk dashboard, letting them gain insight into the semiconductor requirements of future offerings.

- Better partnerships

When OEMs and suppliers team up, there is better transparency and input in forming strategies. For example, OEMs can specify required components instead of merely stating the vehicles to be produced, which automatically triggers semiconductor demand. With supply-demand compatibility, OEMs and suppliers can manage inventory during the midterm to mitigate risk. This way, chips can be distributed to prospective clients much earlier.

They can also invest or participate in semiconductor development, which helps them diversify portfolios while enhancing chip supply and cutting-edge technologies.

- Efficient control rooms

Since COVID-19, companies have relied on lean teams that manage numerous tasks. To ease their load, auto businesses should establish control room workflows that boost efficiency and productivity. New and veteran employees from different departments, such as sales and procurement, can participate in control rooms to help ensure semiconductor inventory. Empowering them to manage midterm supply-demand shortages and formulate strategies can boost chip supply security.

- Resilient tech plans

Auto companies often don't include semiconductor needs in their road maps. With the current chip crunch, they must extensively research their semiconductor requirements for all their potential products. Plans should also include variables that impact chip supply and demand, such as tailor-made vehicles. With a more cohesive tech guide, companies can strategize product development and come up with out-of-the-box solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog