Whatever Happened to NFTs

When non-fungible tokens were first introduced in 2014, it was met with great skepticism. Less than a decade later, we find out that the general public’s suspicion was quite valid.

What made NFTs so popular in 2021? Two events: cryptocurrency entrepreneur Sina Estavi shelling out almost US$3 million for an NFT, the first ever tweet from Jack Dorsey, former Twitter CEO, in March; and when past first lady Melanie Trump launched an NFT collection of a digital rendition of her eyes in December.

But NFTs noticeable growth started during the onset of the COVID-19 pandemic in 2020, when its value tripled to US$250 million. During the first few months of 2021, over US$200 million were invested in NFTs, thanks to art sales and auctions that involved celebrities, artists and high-profile players.

Fast-forward to 2023, and the NFT commodities considered all the rage two years ago are now “worthless”. According to a recent dappGambl report, 95% of NFT assets have become unprofitable investments. The study is based on NFT SCAN and CoinMarketCap data, which stated that out of 73,257 NFT collections, 69,795 have a market capitalization of 0 Ether. This leaves about 23 million NFT people with dead-end investments.

What are NFTs?

Non-fungible tokens (NFTs) are goods or assets digitized and recorded on a blockchain. Each NFT has distinctive identification codes and metadata, setting them apart from other tokens.

Their value depends on various factors like demand, uniqueness and their creator’s popularity or credibility. NFTs represent digital and physical goods—from music, digital art, and domain names to real estate, tickets, and paintings. You can trade your NFTs for other NFTs, cryptocurrency and actual money. Unlike bitcoins, which have a set value (one bitcoin is equal to another), NFTs are “non-fungible”, meaning each NFT is unique and cannot be substituted. This prevents any NFT from being equivalent to another.

A brief history of NFTs

Digital artists Kevin and Jennifer McCoy are said to have created the first NFT in 2014. The duo came up with mandala-inspired digital images, which Kevin essentially developed as an NFT by using blockchain technology to establish provenance and his possession of the digital artwork’s rights.

However, at that time, digital art didn’t merit provenance documents, which verified the creator’s identity, ownership, and estimated value of their specific artwork. After some thought, Kevin eventually collaborated with technology entrepreneur Anil Dash to assess the potential of blockchain technology as a potential solution.

The pair succeeded in minting digital art, laying down the groundwork for what would evolve into a market worth billions of dollars after less than a decade.

Still, it took some time for NFTs to be accepted. Many experts believe that 2017 marked the entrance of NFTs into the mainstream through CryptoKitties, a blockchain game developed by Dapper Labs, a Canada-based studio. NFTs, which users can create, buy, and sell, are represented by digital cats. The game became so popular in December 2017 that it clogged and slowed down the Ethereum network because of its record number of transactions.

Through CryptoKitties, NFTs were able to:

- ignite widespread interest and engagement with NFTs.

- introduce the concept of digital scarcity because each CryptoKitty is a unique digital asset.

- show the effectiveness of blockchain technology in authenticating ownership of digital possessions and the versatility of NFTs since CryptoKitties are transferable to other games and apps.

- showcase the potential of smart contracts, which automated buying and selling processes.

- form enthusiastic communities because many CryptoKitties users also became avid collectors.

- convince artists and creators that NFTs are viable platforms for their work. This breakthrough demonstrated that creative work and other assets can be converted into tokens, signifying a notable shift in art and entertainment.

How did NFTs die?

According to the dappGambl report, the NFTs’ weekly traded value was pegged at approximately US$80 million last July 2023. This is only 3% of its all-time high value in August 2021.

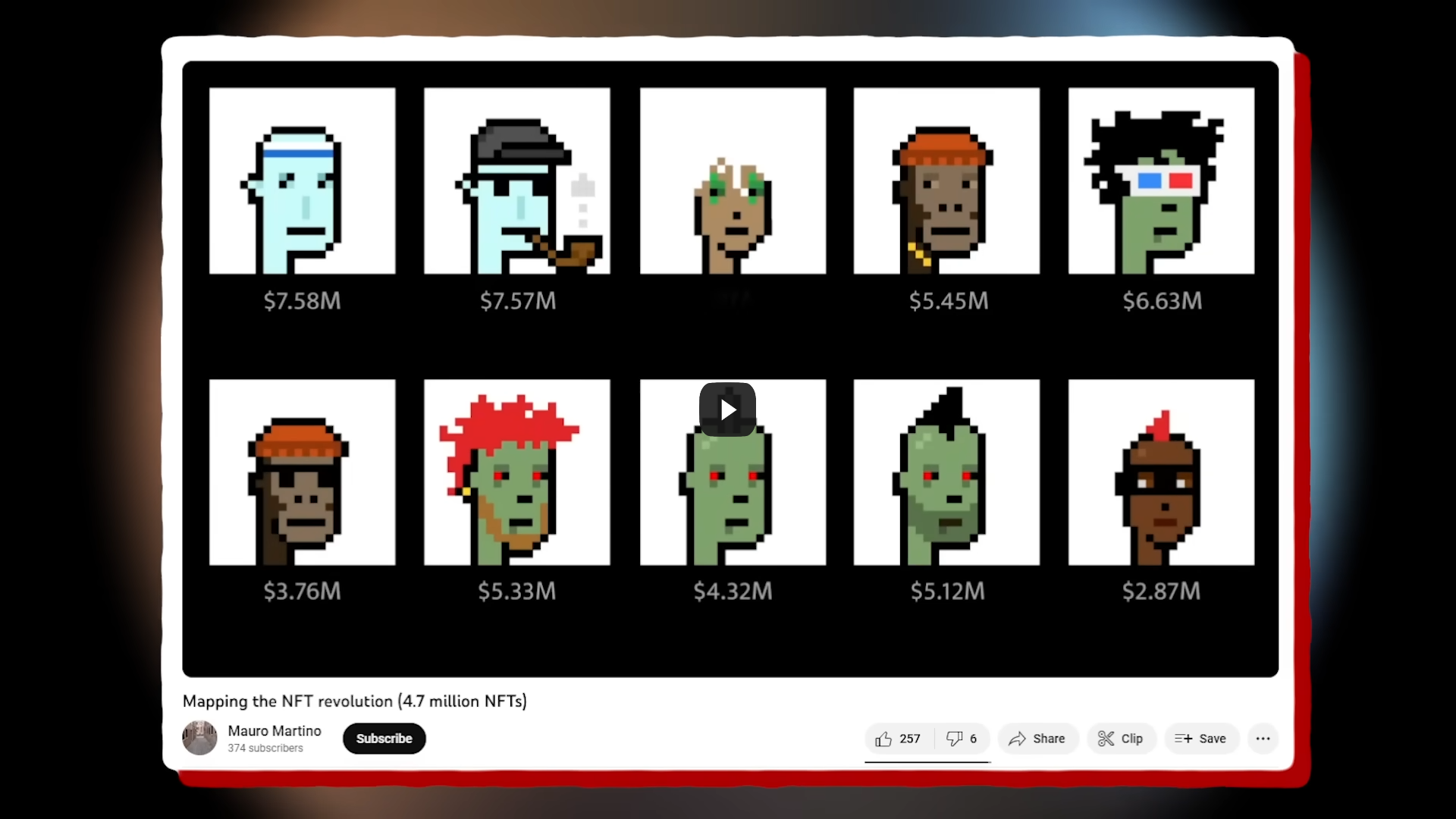

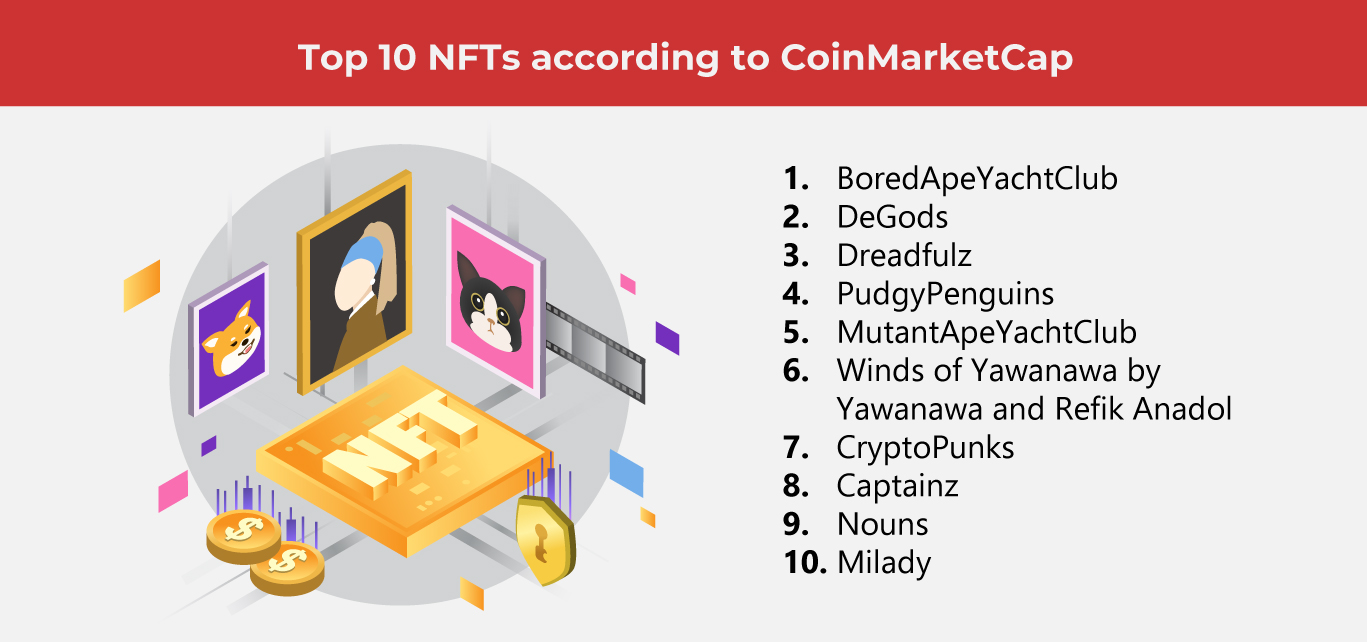

Though the past two years have seen NFTs hitting the headlines and sales worth millions of dollars while earning the interest of celebrities, 2023 marked its decline. Bored Ape Yacht Club, one of the most popular NFT collections that feature cartoon apes, boasted a record-breaking purchase just last year when singer Justin Bieber acquired an NFT for US$1.3 million. But now, the asset dropped to 97% at US$37,000.

Based on observation, the NFT market follows a cyclical pattern, only booming for a few weeks. At the start of the calendar year, profits peak for a few months. But in between, most NFTS lose their marketability and disappear from public awareness. When the next cycle hits, a new batch of NFTs are introduced, and as a result, the old NFTs lose their value. More and more NFTs become worthless as more supply is generated.

79% of NFT collections have not found buyers because of insufficient demand in the market, which the report describes as marked by high speculation and extreme volatility.

The report revealed that 79% of all NFT collections have remained unsold, as there is not enough demand to keep up with the supply in what researchers have described as a “highly speculative and volatile market”.

After studying the top 8,000+ NFT collections based on CoinMarketCap, dappGambl declared that 18% of these top selections had zero value. More than 40% of these had prices between US$5 and US$100, which meant these assets were not considered valuable. Additionally, fewer than 1% of the collections had a value exceeding US$6,000—a significant departure from the million-dollar transactions that characterized the US$22 billion market in 2021.

Simply put, too many NFTs are out there with too little demand. The massive discrepancy between listed base prices and sales data demonstrates poor buyer interest and actual transactions.

Lessons learned

Still, the report says that though the NFT market is falling apart, the technology has potential. For instance, it can be used for items that are relevant and beneficial to users, such as rare add-ons in video games and website-initiated prizes. Due diligence is also necessary before buying anything publicized as high-value, especially in a market filled with risks and possible losses.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today

Other Blog