The Race to Tech Supremacy Heats up with the U.S. CHIPS Act

The CHIPS and Science Act was recently signed into law in the United States, ramping up the race between China and the U.S. for technological supremacy. Read on to know more about the CHIPS and Science Act, the motivations behind this legislation, and its potential impact on the global electronics industry.

“Today, I signed the CHIPS and Science Act into law, a once-in-a-generation investment in America itself,” United States President Joe Biden tweeted last August 10.

With semiconductors powering everything from microwaves and missiles to smart TVs and satellites, there is an urgent need to derisk an industry that is the foundation of today’s digital world. At its core, the CHIPS and Science Act is an economic intervention by the U.S. government to protect the United States against supply chain vulnerabilities and disruptions in the semiconductor industry.

In this article, learn more about the CHIPS and Science Act, the motivations behind this legislation, and its potential impact on the global semiconductor industry.

What is the CHIPS and Science Act?

The CHIPS and Science Act aims to reduce the country’s reliance on overseas supply chains by increasing local semiconductor production, boosting American semiconductor research and development, and nurturing the country’s STEM workforce.

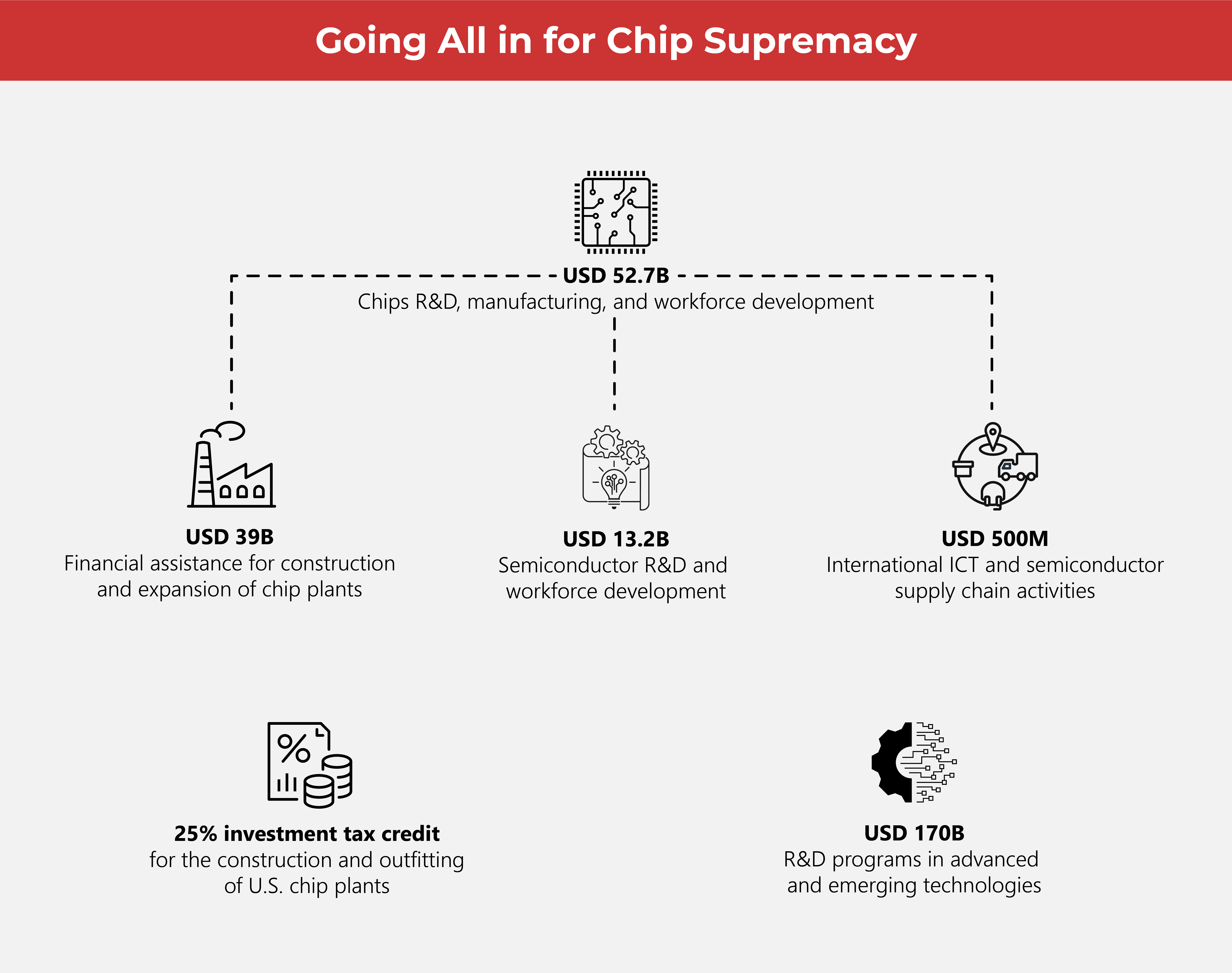

The CHIPS and Science Act provides USD 52.7 billion in subsidies for semiconductor research and production in the United States.

Of this amount, USD 39 billion has been allotted for manufacturing incentives, including USD 2 billion specifically for legacy chips or mature semiconductors used in defense systems and automobiles.

A total of USD 13.2 billion has been earmarked for semiconductor R&D and workforce development, while USD 500 million has been allotted to support international information and communications technology security and semiconductor supply chain activities.

In addition to direct subsidies, the law provides a 25% investment tax credit for building and outfitting chip plants in the United States. This provision is estimated to provide another USD 24.3 billion in support.

The bill also authorizes nearly USD 170 billion in funding over five years for R&D programs in artificial intelligence, quantum computing, nanotechnology, and clean energy. In dollar terms, it is the largest five-year investment in public research and development in the country’s history.

The United States is going all in for tech supremacy and economic and supply chain security. What factors are pushing this move?

A law for reduced dependency and increased security

It’s a digital world where nanometer-sized technology underpins daily life. The demand for semiconductors has surged during material shortages, extreme weather events, a pandemic, and geopolitical conflicts.

Border closures and nationwide lockdowns brought about by a pandemic mean manufacturing plants have to close. Wars hinder access to vital raw materials and disrupt trade routes. Hurricanes and heatwaves in the other corner of the world can destroy facilities, halt production, and result in devastating profit losses and delayed product rollouts.

(Also read: Challenges and Changes for Global Supply Chains)

“The future is going to be made in America”

Semiconductors have a long and convoluted global supply chain fraught with risks. The CHIPS and Science Act is a strategic economic intervention led by the U.S. government to minimize those risks and bring semiconductor manufacturing and development back to its shores.

In 1990, the United States manufactured nearly 40% of the world’s supply of semiconductors. Today, that share is down to 12%. The United States may have created the semiconductor and be home to Silicon Valley, but many American companies operate on a “fabless” model, retaining chip design and development but outsourcing fabrication, primarily to East Asia.

Homegrown tech titans such as Google, Amazon, and Apple rely primarily on East Asian manufacturers for semiconductors. Foundries in Taiwan, South Korea, and Japan make up around 80% of global fabrication capacity. U.S. tech giants Nvidia, Google, and Apple rely completely on Taiwanese foundries for about 90% of their chip production.

Taiwan: the world's dominant (but geopolitically sensitive) chips supplier

Taiwan Semiconductor Manufacturing Co., or TSMC, is the world’s largest contract manufacturer of chips. The USD 550 billion company provides 92 percent of the world’s supply of advanced chips (chips less than 10 nanometres wide) and controls more than half of the global market for made-to-order chips.

Taiwan has not only cornered the market for top-end tech found in game consoles, servers, smartphones, and other everyday electronic gadgets. According to U.S. Secretary of Commerce Gina Raimondo, 90% of the most sophisticated chips used in the U.S. military come from Taiwan.

“So if, God forbid, China were to—in any way—disrupt our ability to buy these chips from Taiwan, it would really be an absolute crisis in our ability to protect ourselves,” Secretary Raimondo shared with Marketplace.

Should the conflict between China and Taiwan escalate, U.S. dependence on such a geopolitically sensitive supplier poses a serious risk—and this may be why the CHIPS and Science Act comes with geographical restrictions.

(Also read: War and the World’s Supply Chain)

A shot across the bow?

“Companies who receive CHIP funds can’t build leading-edge or advanced technology facilities in China for a period of 10 years,” U.S. Secretary of Commerce Gina Raimondo said during a press briefing. “Companies who receive the money can only expand their mature node factories in China to serve the Chinese market.”

Secretary Raimondo also stressed that the CHIPS funding comes with conditions to prevent companies from compromising national security. “They’re not allowed to use this money to invest in China, they can’t develop leading-edge technologies in China, they can’t send [the] latest technology overseas,” Secretary Raimondo explained.

The long road ahead

Because of the lower facilities and labor costs, many American semiconductor companies moved fabrication to Asian manufacturers in the 1980s.

“Every component and supplier is in and around Taiwan, Vietnam, China, Cambodia, Malaysia,” Daniel Ives, managing director of wealth investment firm Wedbush Securities, shared with Foreign Policy. “You can’t just replicate that with the snap of a finger in the U.S.”

(Also read: How Asia Can Future-Proof Global Supply Chains)

The construction of a semiconductor foundry requires 6,000 construction workers, costs USD 10 to 20 billion and can take anywhere from three to five years to build.

“This is a long-term project. But in the long run, it certainly will help,” Russell Harrison, acting managing director of the Institute of Electrical and Electronics Engineers in the United States (IEEE-USA), shared with Scientific American.

“Long supply chains that cross the globe and involve multiple countries and trans-oceanic journeys are vulnerable. No matter how much effort you put into securing them, they’re vulnerable just because they’re long. Producing chips in this country will make the supply chain simpler, cleaner, and easier to protect,” Harrison continued.

The CHIPS and Science Act may be a step in the right direction to bolster U.S. competitiveness in an industry crucial to economic and national security, but it is only the start of a long journey.

As one of the Top 19 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog