The State of Our EV Nation

Electric vehicles (EVs) are redefining the way the Philippines moves toward a cleaner, smarter future. More than a passing trend, they embody a future-ready approach to mobility—one that promotes energy efficiency, reduces environmental impact, and supports the nation’s broader vision of sustainable progress.

In the global race toward net-zero emissions, EVs are driving the transition toward greater sustainability in transportation. These vehicles, which include cars, motorcycles, and other forms of mobility, run on electricity instead of gasoline or diesel. Powered by rechargeable batteries and electric motors, they produce no tailpipe emissions and help reduce fuel costs, driving the green shift.

EVs are gaining momentum in the Philippines as economic, environmental, and policy factors converge. With rising fuel prices, more drivers are seeing EVs as a cost-effective alternative. Growing awareness of air pollution and climate change is also fueling the shift toward cleaner mobility. At the same time, the Electric Vehicle Industry Development Act (EVIDA) supports the local automotive market through tax breaks and tariff reductions, while the rapid expansion of charging infrastructure nationwide is making EV ownership more convenient and accessible.

For Filipinos, EVs are fast emerging as a smart mobility choice shaped by advances in design and engineering. In the long run, they are more affordable to operate, with fewer automotive parts from suppliers required, reducing maintenance needs. With home charging options adding convenience, EVs are redefining the future of everyday travel.

Latest EV updates

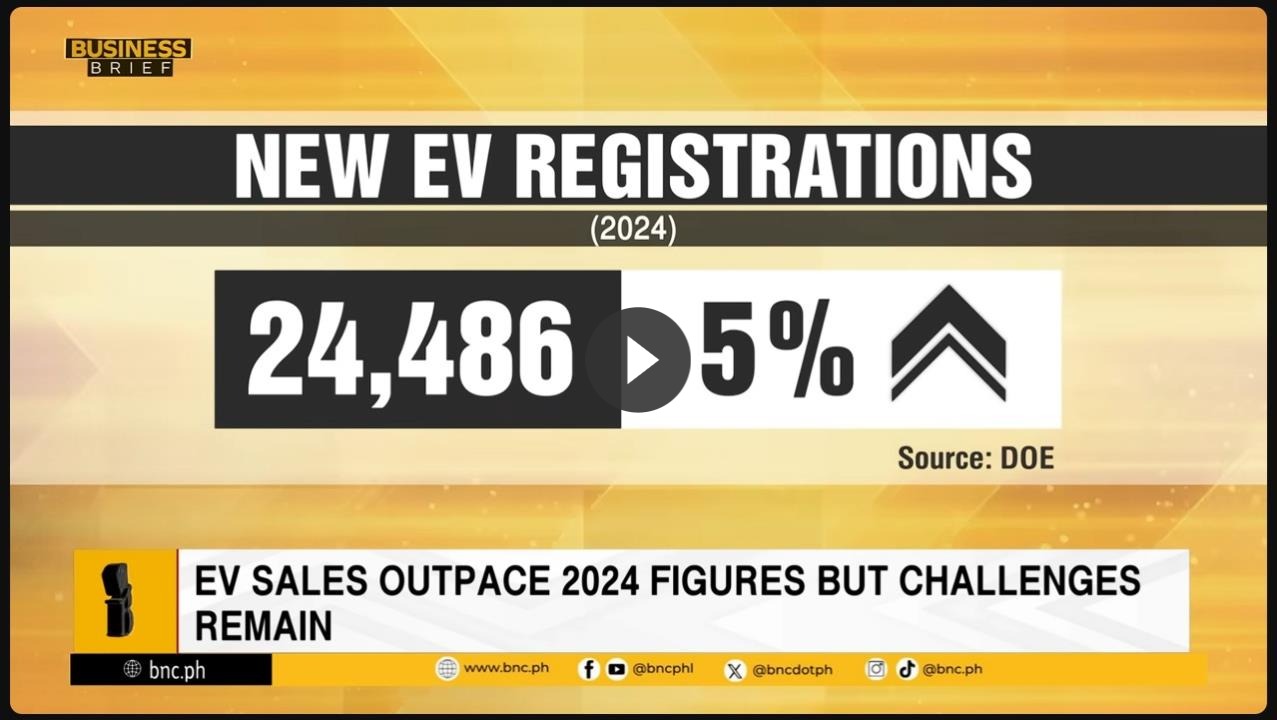

The Department of Transportation–Land Transportation Office (DOE-LTO) reported that 29,715 units were registered between January and July 2025. This already exceeds the total for all of 2024, when 24,286 EVs were recorded—nearly 5% of new vehicle registrations and more than triple the figure from 2023.

EV adoption has surged, according to the Electric Vehicle Association of the Philippines (EVAP). Sales of four-wheeled EVs climbed from 1,028 units in 2023 to 3,880 in 2024, a 277% jump.

EV batteries make up the majority of these sales, while e-bikes and other two- and three-wheeled models soared from just 172 units to over 43,000 within the same period. LTO data also show rising adoption, with EV registrations climbing from 24,286 in 2024 to 29,715 in the first seven months of 2025.

The country’s charging network is also expanding. From roughly 300 charging stations in 2023, the number has grown to 992 by 2025. These include 450 AC chargers and 60 DC fast chargers, with the industry aiming to reach 7,300 stations by 2028.

DOE data shows that around 12% of public EV charging stations are located in malls, led by SM Supermalls with 69, followed by Ayala Malls with 31. Most are in Metro Manila, while Cebu City hosts 14, Davao has seven, and several others operate across major cities in the Bicol region and beyond.

The country’s first lithium battery factory opened in Tarlac in September 2024 under StB Giga Factory Inc. The facility produces lithium iron phosphate batteries for the renewable energy market and EV applications. At full capacity by 2030, it is expected to power up to 18,000 EVs each year.

In June 2025, the Department of Trade and Industry submitted the proposed Electric Vehicle Incentive Strategy (EVIS) for approval. Expected to build on the success of the EVIDA law, EVIS could generate up to ₱11.4 trillion in economic value and create around 680,000 jobs in EV manufacturing, battery production, and charging infrastructure once approved.

(Also read: What EV Charger is Perfect for You?)

Power players driving the PH EV market

According to EVAP, more brands are introducing diverse models across price ranges. Automakers such as BYD, Omoda, Jaecoo, GAC, and Foton have rolled out new options, some priced below ₱1 million, reflecting growing manufacturing capabilities and pushing EVs further into the mainstream.

The Manila Observatory reported that BYD Cars Philippines has rapidly emerged as the leading force in the nation’s EV market through innovation in product design and development, accessible technology, and nationwide expansion.

In 2024, the company posted an astounding 8,900% growth from the previous year, capturing 69% of the EV battery segment. Its distributor, ACMobility under the Ayala Group, also expanded the dealership network to 52 branches and advanced the rollout of charging stations across the country to support its growing presence.

Chinese brands Omoda and Jaecoo are set to widen their reach with 24 new dealerships in 2025, targeting major cities nationwide. Established players such as Nissan, MG, Hyundai, and Changan remain active in the EV space, while Li Auto is gearing up to enter the Philippine market as part of its Southeast Asian expansion.

China remains the Philippines’ leading source of EVs and vital components, strengthened by its manufacturing excellence and efficient supply chain management. Dominating the global battery market and the supply of key minerals like lithium and cobalt, China provides most of the lithium-ion batteries powering Philippine EVs. With affordable pricing, dependable parts, and strong after-sales support, Chinese EVs continue to be the most practical option for a market still building its own technical and R&D capabilities.

(Also read: A Deep Dive into China’s EV Empire)

Roadblocks to EV adoption in the PH

Despite progress in global manufacturing and local policy support, the Philippines still faces several hurdles that slow the widespread adoption of EVs.

- Inadequate EV infrastructure

Charging stations remained far below targets, creating “range anxiety” among drivers who fear running out of power before reaching a charger.

- Urban concentration

Most EV charging stations remain concentrated in Metro Manila’s malls and business districts, limiting access for provincial users. Expanding full-capacity charging hubs nationwide is vital to ease range concerns.

- High initial investment

EVs are priced up to twice that of traditional cars. Expensive batteries, limited local production, and high electricity rates continue to hinder affordability and broader market adoption.

- Import dependence

With an import-driven EV market and no local manufacturing base, the Philippines remains vulnerable to global supply fluctuations, foreign pricing pressures, and missed opportunities for domestic innovation and industry growth.

- Policy gaps

EVIDA spurred EV adoption through tax incentives and buyer perks, yet policy and infrastructure support remain insufficient to reduce import dependence and address persistent technology and industrial manufacturing challenges.

Driving toward a sustainable future

Electric mobility in the Philippines has shifted from vision to reality, gaining momentum as technology advances and infrastructure slowly takes shape. Sustained progress, however, depends on fostering local manufacturing, expanding charging networks, and reducing import dependence to build a truly resilient EV ecosystem.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog