Why EV Battery Production Is on the Rise This 2025

Electric vehicle (EV) sales are steadily rising worldwide, though growth rates vary by region. While China and Europe see strong demand, the U.S. has experienced a slower shift. Reshoring EV battery production, which began gradually during the COVID-19 pandemic, has now accelerated into a massive surge.

As demand soars and costs drop, the battery industry is evolving at a rapid pace. In 2024, electric vehicle sales jumped 25% to 17 million, pushing annual battery demand past 1 terawatt-hour for the first time. With the EV battery market expected to grow from $91.93 billion in 2024 to $251.33 billion by 2035, shifting automobile industry market shares are reshaping the sector.

Meanwhile, the cost of battery packs for electric vehicles fell below $100 per kilowatt-hour, a crucial benchmark for achieving price competitiveness with traditional gasoline-powered cars.

Top 5 Reasons for the EV production boom

Several key factors have fueled the rapid expansion of EV battery production, from policy incentives to shifting market demands.

-

Supportive policies

The Inflation Reduction Act (IRA), signed in 2022, played a key role in accelerating EV battery production and strengthening the U.S. renewable energy market.

In 2019, only two battery factories were operational, but today, around 34 are planned, under construction, or active. The IRA’s incentives encouraged automakers and battery manufacturers to invest over $112 billion in domestic production, aiming for a 1,200-gigawatt-hour annual capacity by 2030—enough to power 18 million EVs.

Although President Trump froze IRA funding in 2025, private investments continue, driven by the need for supply chain control and tariffs on Chinese imports. The IRA’s tax credits promote North American battery sourcing, with requirements increasing through 2029, while past manufacturing credits helped expand production. Overall, the policy has fueled $245 billion in private investment.

-

More affordable battery materials

Declining battery mineral costs, especially lithium, which has fallen over 85% since its 2022 peak, have boosted the economic value of EV production. However, industry advancements are also driving prices lower. After years of investment, global battery manufacturing capacity hit 3 terawatt-hours in 2024. If planned projects materialize, capacity could triple in the next five years, further enhancing efficiency and affordability while strengthening the economic value of large-scale battery production.

-

Increased EV adoption

The surge in EV adoption has fueled a rapid expansion in battery production, driven by the need for greater efficiency, lower costs, and sustainability. As consumers and governments push for cleaner transportation, manufacturers are scaling up battery output to meet rising demand. This growth not only supports widespread EV adoption but also advances energy storage technology, reducing emissions and decreasing reliance on fossil fuels.

-

Rising need for efficient, fast-charging batteries

Escalating demand for longer-range, faster-charging EV batteries has fueled major manufacturing solutions. BYD's 1,000-volt platform enables nearly 300 miles of range in just five minutes. Toyota’s C-HR Plus offers 373 miles per charge. Breathe Battery Technologies’ algorithm boosts lithium-ion charging speeds by 30%. Advances in solid-state batteries and silicon anodes continue to enhance range and efficiency, reinforcing the industry's focus on sustainability and innovation.

-

Strategic investments and partnerships

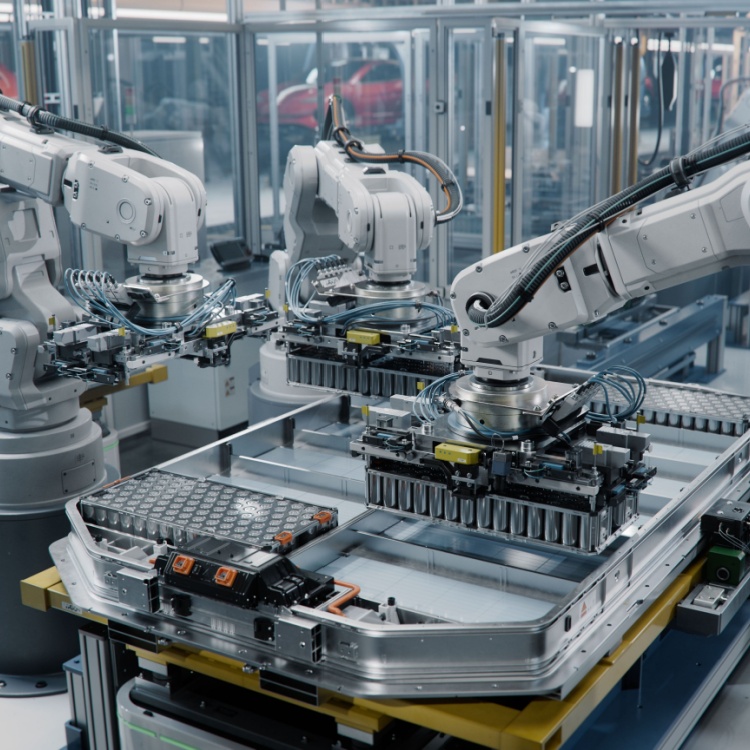

The EV battery sector is experiencing rapid growth, propelled by partnerships and substantial investments from original equipment manufacturers (OEMs) and automotive parts suppliers. In December 2024, Stellantis and CATL announced a €4.1 billion joint venture to establish a lithium iron phosphate (LFP) battery plant in Zaragoza, Spain, aiming for a 50 GWh capacity by 2026. Concurrently, Mazda is implementing cost-saving measures to maintain its ¥1.5 trillion electrification investment through 2030, including collaborations with Toyota and Denso.

Top 5 Global EV battery trends

The battery industry has shifted from fragmented, regional markets to a large-scale, global sector driven by standardization. Competitive edge now relies on economies of scale, supply chain management, and rapid innovation deployment. Discover the EV battery trends that will shape the industry's future.

-

China remains dominant

China’s engineering capabilities have made it the dominant force in battery production, accounting for over 70% of global supply. In 2024, battery prices there fell nearly 30%, making them over 30% and 20% cheaper than in Europe and North America. Key factors include extensive manufacturing expertise, supply chain integration, a focus on LFP batteries, and intense competition. Despite potential consolidation, China will likely maintain its lead.

-

EU emerges as a major player

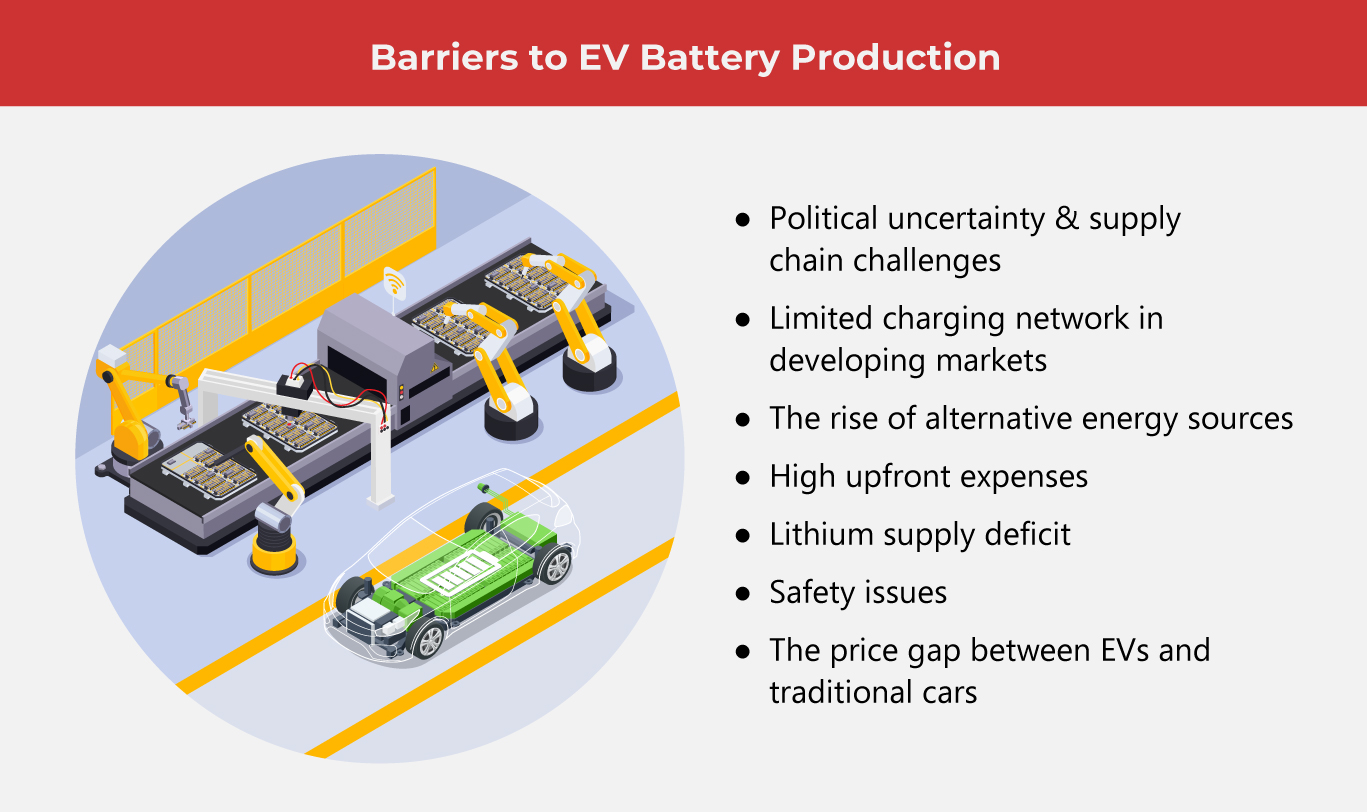

Europe’s EV battery market is set for rapid growth, driven by strict emissions targets, rising EV demand, and major investments. The EU’s 2035 zero-emission mandate is accelerating adoption, with manufacturers like Stellantis and BMW expanding production. However, high costs and weak supply chains challenge growth. To compete, Europe must strengthen domestic demand and reliability testing while increasing LFP battery production, as foreign companies expand their European presence.

-

Other countries are enhancing battery production

Korea and Japan are key players in the battery sector, with leading manufacturers and specialized suppliers excelling in nickel-manganese-cobalt technology. Though domestic production is limited, Korean firms dominate overseas capacity, supplying over 20% of global demand in 2024. Meanwhile, Southeast Asia and Morocco are emerging as battery hubs, attracting investment due to resources and strategic trade agreements, further strengthening their role in electronics exports and battery component manufacturing.

-

Finding ways to strengthen the battery sector

Governments worry about concentrated battery supply chains, especially after China’s proposed export limits on key technologies. Expanding domestic production is costly and time-consuming, requiring strong EV demand, automation, and collaboration with established producers. International partnerships are also vital, as many markets lack scale for independent battery manufacturing. Cooperation with resource-rich nations can help diversify supplies and reduce reliance on dominant players like China.

-

Strong growth for solid-state batteries

Solid-state batteries are set for strong growth in the EV market, promising higher energy density, faster charging, and improved safety. By using a solid electrolyte instead of liquid, they enhance thermal stability, lower fire risks, and extend lifespan. Their ability to boost EV range and charging efficiency makes them a key innovation. Recent advancements highlight their rising potential to reshape electric vehicle technology and accelerate adoption.

As nations strive to expand their battery manufacturing capabilities, innovation and supply chain diversification remain critical. Overcoming challenges such as resource shortages and cost disparities will shape the future of EV adoption, paving the way for a more efficient, sustainable, and electrified transportation landscape.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog