What the Current Crises Mean for Manufacturing

After contending with a global pandemic, geopolitical tensions and conflict further complicate an already uphill battle for the global manufacturing industry. IPC’s industry sentiment report shows us its main pain points for each region.

The electronics manufacturing industry is a major cog in the global economy. To the multitudes working outside it, we ordinarily take its machinations and complexities for granted. Though we may not be aware of much about it, we not only feel its impact every day, we are direct contributors to how it develops by simply using everything around us that is powered by electronics.

When major events such as a global pandemic or war hit, these cause shifts in supply chains around the world, and these shifts are closely measured by those in the manufacturing industry to ensure that the cog does not stop churning. Conditions and key indicators such as material costs, labor costs, backlogs, orders, shipments, inventory indexes, and profit margins are consistently being monitored so the industry can keep up with the ever-growing demands of our fast-paced digital lifestyles.

These conditions are very sensitive and fluctuate depending on many external factors. A finger on the pulse of the industry sees to the health of this part of the electronic ecosystem.

The Institute of Printed Circuits (IPC), produces regular sentiment reports for the electronics manufacturing industry. These reports summarize key takeaways that impact the industry as they hit and show areas that are the most affected by current challenges the most.

(Also read: Challenges and Changes for Global Supply Chains)

In 2020, the biggest challenge was COVID-19. As industries slowly start to recover, restart, and adjust to their new realities, another major challenge asserts itself in 2022—the war in Ukraine.

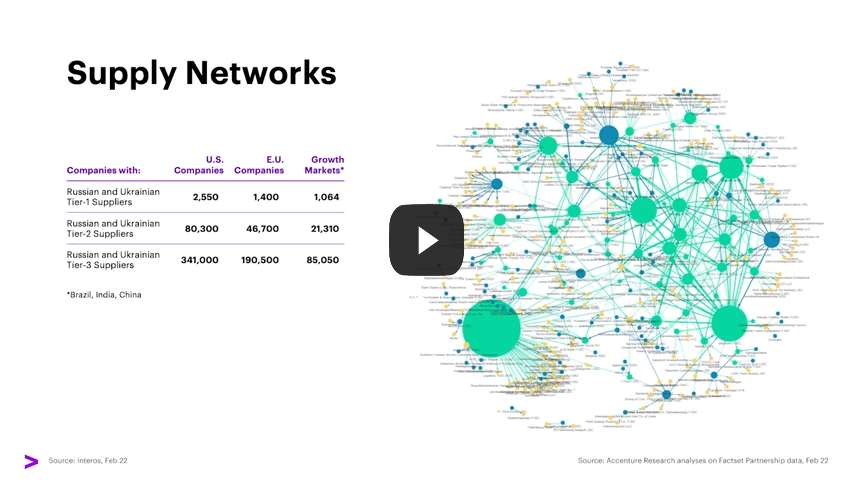

In March 2022, Deloitte projected that the disruption in Ukraine will further weaken global supply chains. Because many other regions depend on Russia for natural gas and crude oil products, this was an inevitability that highlighted vulnerabilities in the supply chain. Apart from this, as noted by Deloitte, Russia is a vital source of global mineral supply, accounting for 30% of platinum-group minerals, 13% of titanium, and 11% of nickel.

Fast-forward to May, and IPC’s sentiment report measures just how this event combined with other events that happened simultaneously around the world tipped the electronics manufacturing industry indexes a few more notches toward tough.

Pain Points and Outlook per Region

According to IPC’s Current Sentiment of the Global Electronics Manufacturing Supply Chain, the largest “pain point” for electronics manufacturers worldwide is cost. The big C-word cuts across materials and labor, with nine out of ten manufacturers currently facing challenges in rising numbers for materials costs. Four out of five manufacturers are currently experiencing rising labor costs. There is difficulty recruiting and hiring skilled workers.

Rising costs for materials and rising costs for labor are present across all regions. However, when examined per region, the report shows that not all regions suffer equally nor are their conditions the same. Some are doing significantly better than others.

For example, the report shows that compared to the Asia Pacific (APAC) region, Northern America is lagging in terms of ease of recruitment. Ease of recruitment is significantly higher in APAC by 21% than in Northern America, which only shows 4%. It may not tell us the whole story but a quick peek into Statista’s minimum monthly wages for APAC in 2022 may clue us in on one of the reasons why.

Backlogs are higher in Northern America than in APAC. Northern America has backlogs of 59% compared to APAC’s 33%.

When it comes to inventory from suppliers, APAC is improving at 21%. Meanwhile, Northern America inches by at 5%.

The global outlook for the next six months shows continuous challenging conditions. However, even in outlook, there will still be differences per region. Electronics manufacturers should expect things to continue to be more challenging as materials costs and labor costs continue to increase. There are projected continued declines in inventory available from suppliers as well as profit margins.

The regional outlook for APAC indicates a more optimistic trend over Northern America. The report shows that material costs are expected to decline for manufacturers operating in APAC more than their counterparts in Northern America. When it comes to labor costs, these are also expected to decline over the next six months compared to firms operating in Northern America.

Demand overall remains strong, though because of our increased digitalization of daily life, backlog is increasing. Inventories remain tight, the report states.

The report also shows the general global sentiment of manufacturers that governments are not doing enough to stimulate innovation and capacity in the semiconductor industry. According to IPC, only three in ten electronics manufacturers feel positive about their governments’ efforts to spur on the industry. The report did not specify which countries. Interestingly, firms operating in APAC are more likely to agree with this statement compared to other firms operating in Northern America.

Half of the manufacturers are aligned in thinking that their governments’ semiconductor goals are essential and connected to other key investments in the larger electronics ecosystem. Support and infrastructure from governments to spur innovations in the industry are urgently needed.

As one of the Top 19 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.