Our EV Future: The Road So Far

With fuel prices increasing, the demand for electric vehicles is fast on the rise. How did the global EV market fare in 2021, and what challenges lie on the road to EV adoption?

Back in 2012, around 130,000 electric vehicles (EVs) were sold around the world. Today, that many are sold in a single week.

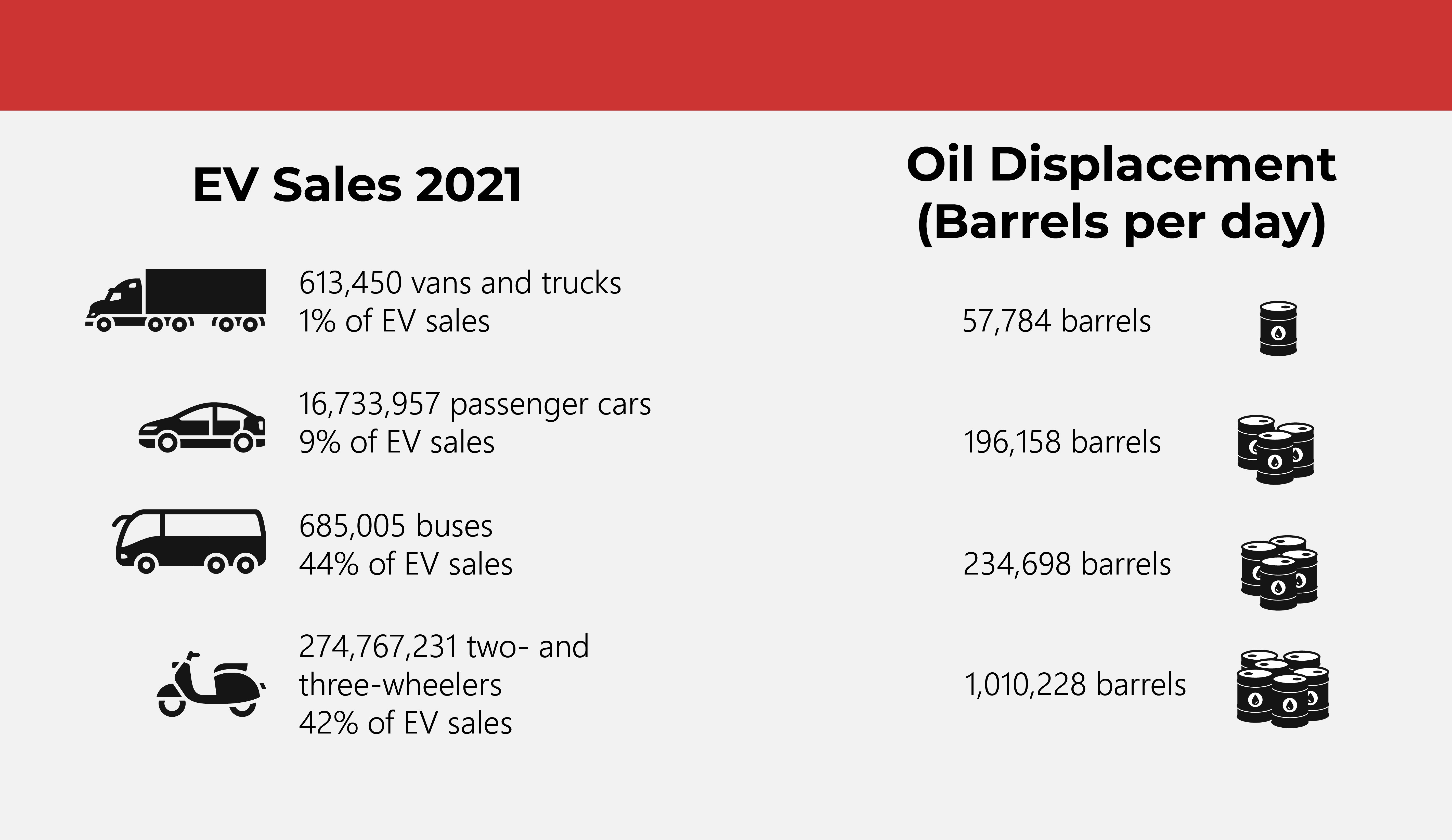

According to the latest Electric Vehicle Outlook by BloombergNEF, today’s EVs are displacing 1.5 million oil barrels per day, which amounts to about 3% of total road fuel demand.

The shift from internal combustion energy (ICE) vehicles to EVs means cleaner vehicles, cleaner roads, and a greener earth. In this article, we take a closer look at the numbers for the EV market in Europe, the United States, and China. We’ll also delve into the reasons for the industry’s success as well as obstacles it will have to surmount to make net-zero roads a reality.

(Also read: Net Zero's Challenge to Industries)

Making inroads around the world

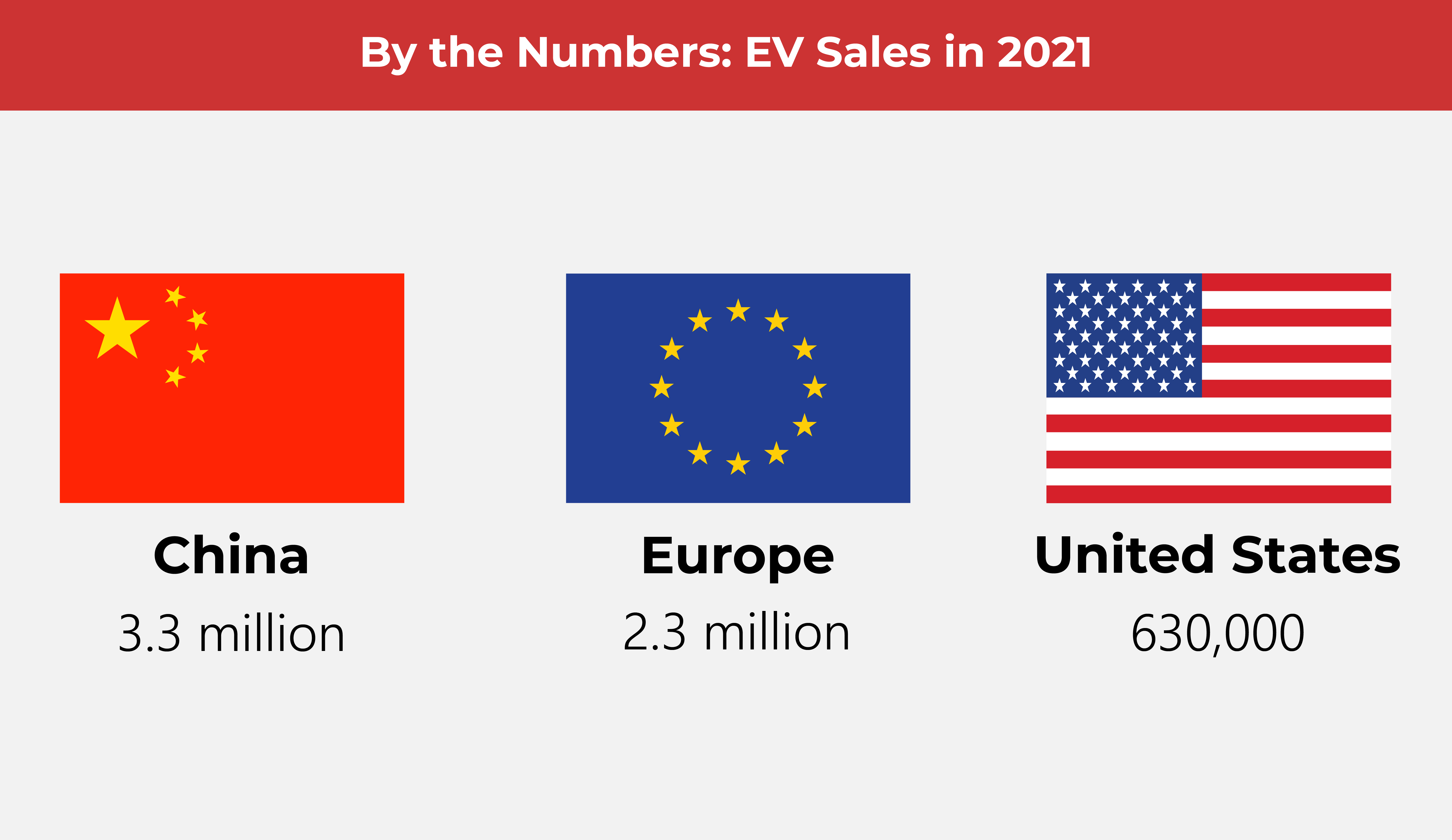

EV sales doubled in 2021 to a record-breaking 6.6 million, according to the latest edition of the annual Global Electric Vehicle Outlook by the International Energy Agency (IEA). Despite supply chain woes, sales grew steadily into 2022. Two million EVs were sold worldwide in the first quarter of 2022, up by 75% from the same period in 2021.

China leads the charge toward EV adoption, with EV sales nearly tripling in 2021 to 3.3 million. Experts point to several factors behind China’s success. First of all, the country’s EVs are typically smaller than those in other markets–and come with a significantly smaller price tag. In China, the average price of an electric vehicle is only 10% more than that of ICE vehicles. In other major automotive markets, EVs are 45% to 50% more expensive than traditional vehicles.

The government is also throwing its support behind the Chinese EV market, attracting car owners with EV subsidies and incentives and extending financial assistance to the country’s automakers.

(Also read: Powering the EV Arms Race)

In Europe, EV sales grew by 65% to 2.3 million, a surge that was driven by new CO2 emission standards as well as increased purchase subsidies in major European markets. Monthly sales peaked in December 2021 with a 21% market share. For the first time, European sales of EVs surpassed that of diesel vehicles.

At 630,000, EV sales in the United States more than doubled in 2021, with electric vehicles doubling their market share to 4.5%. In the U.S. market, Tesla remains in pole position, accounting for more than half of all electric units sold in the country.

Policies, pledges, and targets established by both governments and automakers are driving the global electric vehicle market forward. Titans of the automotive industry are investing heavily in electrifying their fleets. In 2021, there were five times more new EV models on the market than there were in 2015–a testament to the automotive industry’s commitment to making the world’s roads carbon-free. According to the IEA, public spending on EV subsidies and incentives nearly doubled last year, reaching almost USD 30 billion.

“Few areas of the new global energy economy are as dynamic as electric vehicles. The success of the sector in setting new sales records is extremely encouraging, but there is no room for complacency,” said IEA Executive Director Fatih Birol.

“Policymakers, industry executives, and investors need to be highly vigilant and resourceful in order to reduce the risks of supply disruptions and ensure sustainable supplies of critical minerals,” Birol continued.

Gearing up for an EV future

Strong policy support, a more aggressive EV industry, and a stronger commitment to net zero have all helped create a growing and dynamic EV market.

But there are several barriers to widespread EV adoption. The cost of minerals critical to EV battery manufacturing is soaring. Year on year, the price of lithium carbonate increased by 150%, graphite by 15%, and nickel by 25%. With the growing demand for key materials, the shortage of raw materials could cause EV battery costs to spike 22% by 2026. As the race to dominate the EV market heats up, scientists and auto industry leaders are developing new battery technologies to power our future.

The microchip shortage also poses a serious threat to EV adoption, especially since EVs require twice as many microchips as traditional vehicles. Several automakers, from Tesla to Volkswagen, have taken it upon themselves to design and develop their own chips for their EVs.

The lack of public charging infrastructure is also a concern. EV drivers need fast and convenient charging locations to combat range anxiety and ensure they arrive at their destinations. Government support through mandated charging stations in buildings, parking spaces, and new buildings would help expand EV charging infrastructure to adequately support the EV market.

(Also read: The EV Charging Stations of the Future)

As we’ve seen in the past year, the EV market has overcome a pandemic, supply chain woes, and geopolitical tensions and emerged with record-breaking sales. The road to widespread EV adoption may be fraught with challenges, but continued policy support, infrastructure expansion, and industry innovation could help accelerate EV adoption around the world.

As one of the Top 19 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.