10 Auto Camera Trends You Should Know

The automotive camera design and technology sector is experiencing rapid growth, driven by increasing adoption of advanced driver-assistance systems (ADAS) and regulatory requirements such as U.S. rearview camera mandates. Market value is projected to rise from $8.4 billion in 2025 to $15.34 billion by 2032, reflecting a 9% CAGR. Revenue from automotive camera modules alone reached nearly $6 billion in 2024 and is expected to grow to $8.7 billion by 2030, highlighting the rising demand for future-ready automotive camera systems.

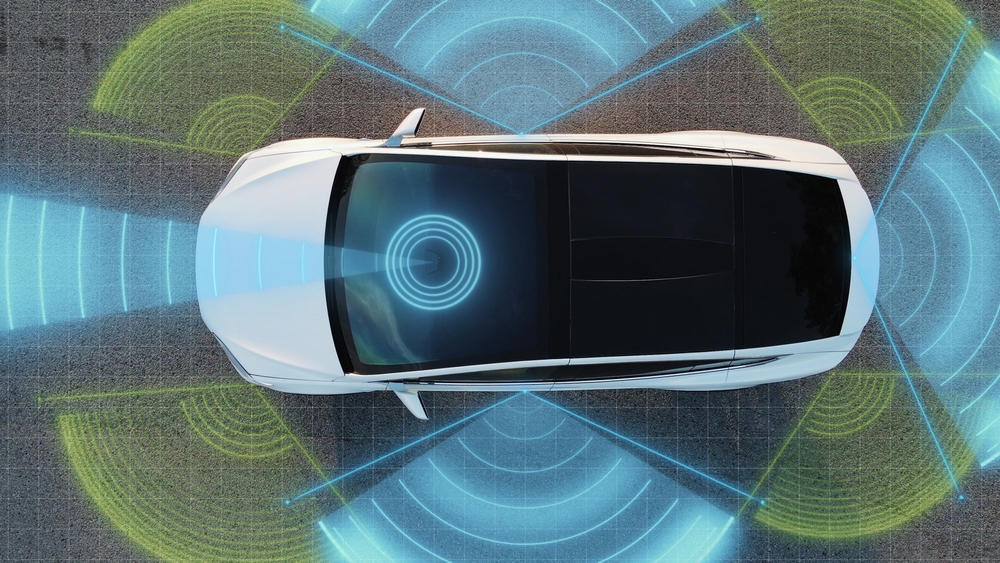

ADAS and autonomous driving technologies are evolving rapidly, with automakers focusing on solutions that improve driver awareness and prevent accidents caused by missed signals or pedestrians. These innovations are transforming vehicles, allowing them to monitor surroundings, provide alerts, and assist in control for safer and more comfortable driving, reshaping the future of the automotive market.

Alongside these advancements, trends in product design and development are driving smarter, more compact sensing systems that enhance safety features, optimize vehicle performance, and support the next generation of driving solutions.

(Also read: Driving Precision Forward: IMI’s Award-Winning Stray Light Tester for Automotive Cameras)

Leading automotive camera innovations in 2025

In the world of modern vehicles, camera vision technology is bringing a new level of awareness to every drive, quietly making journeys safer and more intuitive for everyone on the road. Here, we explore the key trends shaping this technology and how it’s evolving in 2025.

1. Imaging Products in Demand

Dash cameras remain popular, especially during holiday seasons and new car launches, making it an ideal time to introduce advanced models. Backup cameras are also seeing increased interest following post-holiday purchases and insurance requirements. High-demand 4K dash cams with night vision and LTE are enhanced with better app connectivity and thermal imaging, improving user experience and keeping pace with evolving camera trends.

2. AI-driven camera systems

Nikon and Mitsubishi Fuso exemplify the growing trend of new product introduction in AI-powered in-vehicle camera systems. These solutions integrate telephoto and wide-angle lenses to deliver near-complete 360-degree coverage while reducing installation costs and failures. By combining optical technology with real-time image processing, they detect distant signs and nearby objects more effectively, highlighting the broader industry shift toward smarter, AI-enhanced imaging solutions in trucks and buses.

3. Multicamera architecture

The shift from single front-facing cameras to distributed multicamera systems is reshaping ADAS. By integrating zonal computing and sensor fusion, vehicles now process inputs from side, rear, and surround-view cameras, enabling a more complete visual inspection of their environment. The 360° surround-view camera plays a key role, especially in parking assistance and Level 2+ automation. This trend improves situational awareness and reduces blind spots.

4. Smart feature fusion

Driver monitoring systems (DMS) are becoming a key focus for both regulations and vehicle design in Europe and beyond. Advances in system integration combine Red, Green, Blue – Infrared (RGB-IR) and global shutter sensors with evolving lens technologies, moving toward hybrid solutions that cut costs while boosting performance. Meanwhile, new camera functions like e-mirrors and exterior access cameras are appearing on high-end electric vehicles (EVs).

5. Advancements in sensors

High-resolution 8-megapixel sensors are increasingly used in ADAS cameras to extend perception range and enhance sensor fusion quality. The industry is focusing on research to improve high dynamic range (HDR) and light field microscopy (LFM) capabilities while reducing pixel size. Inside the cabin, systems are adopting RGB-IR sensors with emerging 3D time-of-flight (ToF) and global shutter technologies. Rigorous product testing ensures these innovations support smart airbags and biometric monitoring effectively.

6. Advanced packaging

The growing demand for automotive imaging systems is driving the adoption of robust packaging solutions. Integrated Ball Grid Array (iBGA) packaging is leading in ADAS and driver monitoring systems, offering superior stability and performance. Cost-sensitive viewing cameras continue to rely on advanced Chip-Scale Package (aCSP) technology, while ceramic packages are losing ground due to high costs and scalability limits. Comprehensive thermal analysis is essential to ensure these packages maintain reliability under demanding vehicle conditions.

7. Automotive color filter advancements

Emerging filter technologies like RCCB (Red-Clear-Clear-Blue) and RCCC (Red-Clear-Clear-Clear) are replacing traditional Bayer filters in automotive imaging systems. These new arrays enhance low-light sensitivity by incorporating clear pixels, which allow more light to reach the sensor, improving signal strength and reducing noise. This is particularly crucial for detecting red signals, such as brake lights, during nighttime driving.

8. Emerging imaging technologies

The automotive industry is exploring advanced imaging technologies to enhance safety under low-visibility conditions. Hyperspectral imaging, short-wave infrared (SWIR), and gated imaging are at the forefront of this innovation, offering superior performance in detecting objects and signals in challenging environments. However, the adoption of these technologies is hindered by high costs, which impact their economic value proposition for widespread use. Researchers are working to lower expenses through ongoing development.

9. Centralized architecture

Adopting centralized architectures for imaging systems involves distributing satellite cameras throughout the vehicle, each transmitting pre-processed data to a central electronic control unit (ECU) via high-speed Ethernet connections. By consolidating data processing, this architecture enables more effective sensor fusion algorithms, leading to improved decision-making and enhanced vehicle safety. The integration of such systems necessitates rigorous product testing to ensure reliability and performance under various driving conditions.

10. Tech stack evolution

Emerging optical technologies are being integrated and fused with automotive radar sensors to enhance vehicle perception capabilities. These advancements include the incorporation of Near-Infrared (NIR), Short-Wave Infrared (SWIR), and thermal imaging (LWIR) technologies. The adoption of these systems is crucial for improving vehicle safety and performance under challenging driving conditions, such as darkness, fog, or sun glare. To ensure their effectiveness, comprehensive reliability testing is conducted, evaluating their performance across different scenarios.

(Also read: Enhancing Automotive Vision: IMI’s Advanced Camera Manufacturing Capabilities)

Shaping the future of vehicle safety

Automotive camera innovations are critical for enhancing driver awareness, improving safety, and enabling advanced driver-assistance and semi-autonomous systems. As sensor resolution, AI processing, and multi-camera architectures continue to evolve, we can expect even smarter vehicles capable of better object detection, real-time decision-making, and seamless integration with vehicle networks. These technologies not only reduce accidents but also pave the way for fully autonomous driving, transforming how we experience mobility.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog