Better Together? The Chip 4 Alliance

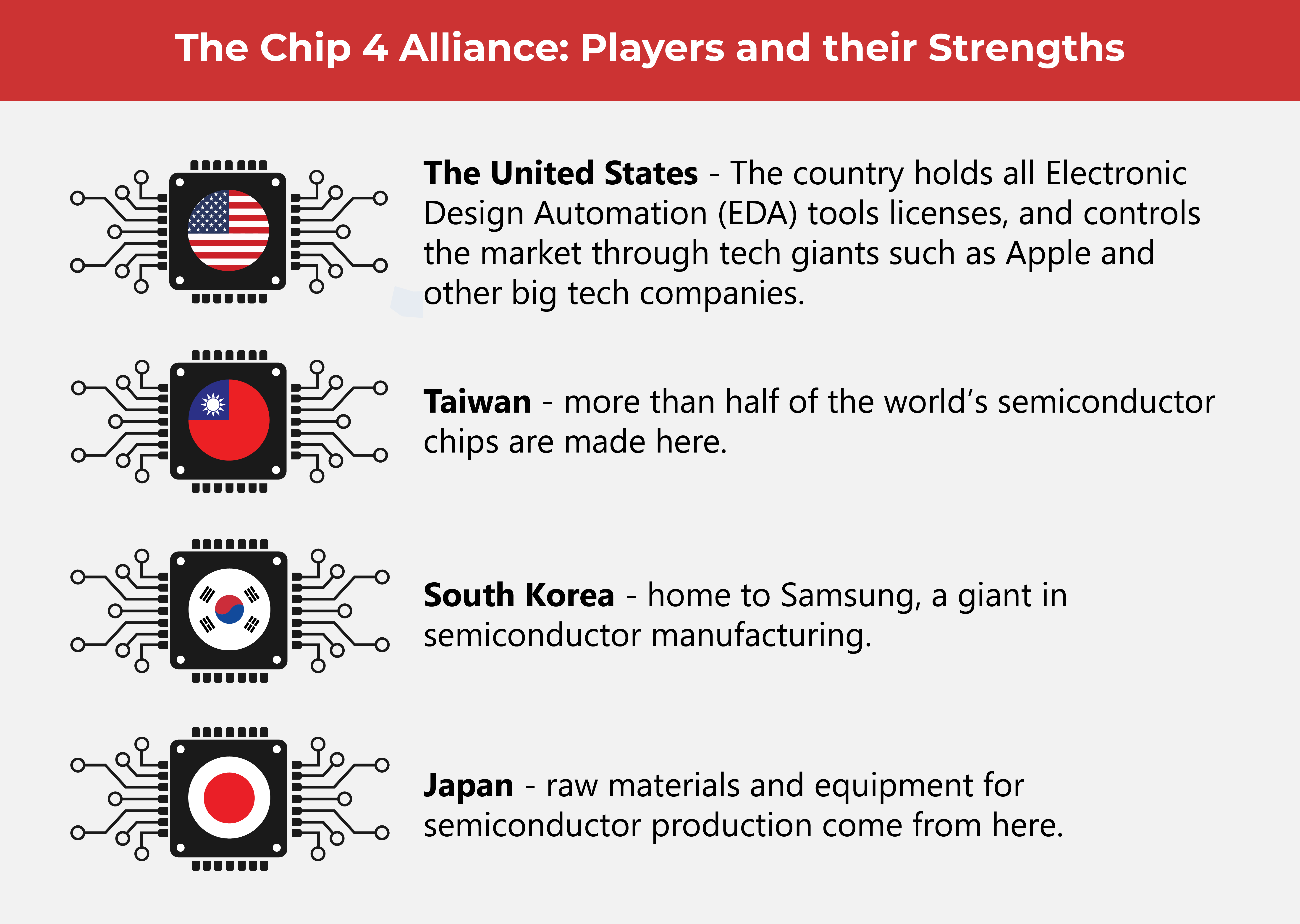

Who are the players in the Chip 4 Alliance, and how does it stand to help the semiconductor industry? Here’s what you need to know about the proposal that aims to bring together four of the strongest semiconductor nations and leave China behind. Can they do it?

U.S. President Joe Biden signed the CHIPS (Creating Helpful Incentives to Produce Semiconductors) and Science Act in August 2022. The law aims to boost tech companies in the country by allocating billions of dollars for the set-up of design and manufacturing facilities in the United States, decreasing dependence on imports from other countries for the production and manufacture of semiconductor chips.

(Also read: The Race to Tech Supremacy Heats Up with the CHIPS Act)

While incentives are powerful and much-needed in order to revitalize the make more resilient an industry still recovering from the impact of the chip shortage, it may not be enough.

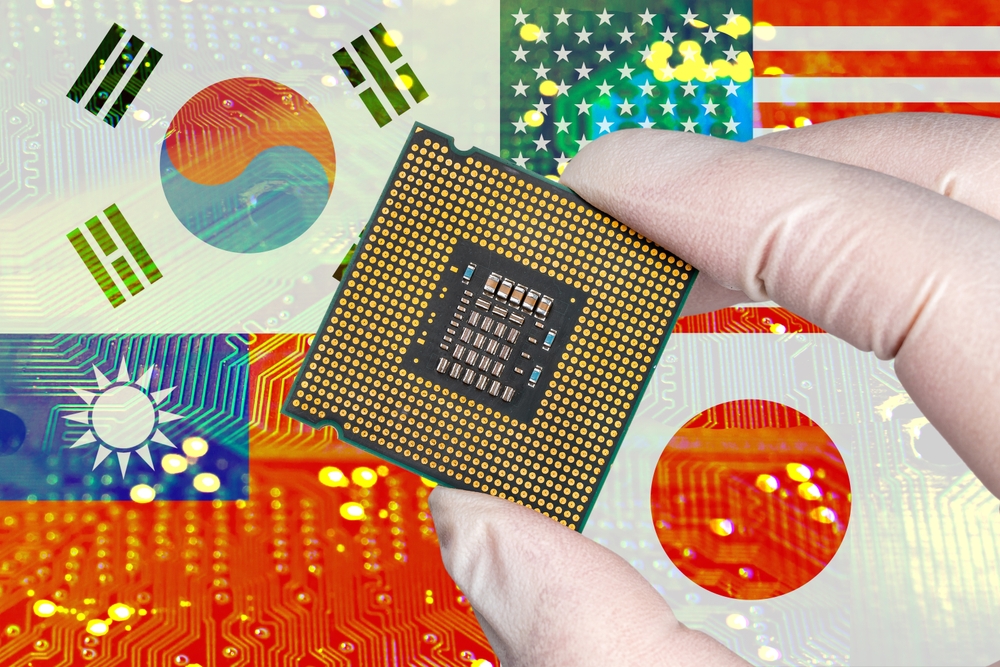

Earlier in March, the U.S. government proposed an alliance that aimed to bring together three of the strongest semiconductor giants in Asia– Taiwan, Japan, and South Korea, to weaken China’s growing dominance not just in the semiconductor industry, but in matters of economic, military, and diplomatic concerns as well.

U.S. officials have become alarmed because of China’s growing capture of the 5G network market. Huawei, which is based in Shenzhen, owns most of the 5G patents. Apart from this, the United States is against China “stealing intellectual property from American companies, such as turbine technology for windmills, as noted by TRTWorld.com.

The United States views semiconductor production as a matter of national security, and its government hopes that by bringing in some of its Asian allies into the fold, it can decrease its reliance on China, and strengthen industry on its own shores.

The United States is hoping to leverage its diplomatic relationships with these countries, and woo them over to their side. The challenge for the United States is, are these countries willing to cut off ties with China?

Each of these countries all stands to gain (and lose) important things by agreeing to join the alliance, and this is why the Chip 4 Alliance is being held under so much analysis and scrutiny by tech leaders, analysts, and even scholars around the globe.

It won’t be easy to persuade each nation to join the alliance, even though things look good on paper. So many nuances come to the fore, and delicate economic, diplomatic, and even military considerations play important roles.

Formal discussions have yet to commence between these four countries, but initial state visits from Vice President Kamala Harris have nudged the discussions to move forward in November of this year.

News reports say that South Korea may be tricky to persuade because the country relies on China for its exports. In 2021, 48% of South Korea’s exports went to China, totaling $69B. Furthermore, South Korea is hesitant to ruffle feathers because of what happened in 2016. China imposed embargoes on South Korean products when it agreed to deploy anti-missile systems from the U.S., impacting Korean businesses reliant on exports to China.

Meanwhile, other reports are calling Taiwan and Japan more optimistic players in favor of the alliance, but a deeper look into each country may indicate otherwise.

Though Taiwan might benefit from getting help from the U.S. against China’s ever-increasing threats to occupy Taiwan and reclaim the country, Taiwan is still carefully weighing the proposal carefully. Tech analyst Xiang Ligang says that it is “50% more expensive to build a factory in the U.S. than Taiwan, taking longer, with costs likely to double.” Problems with recruitment and retention of talent may also arise.

As for Japan, it shares a similar view with the U.S. when it comes to national security and semiconductors, and according to Nikkei, Tokyo is “expected to prioritize national security over short-term economic gain” by agreeing with the United States in restricting exports of semiconductors to China. However, the country is also looking at how the alliance can possibly compensate Japan’s chip industry when China is excluded.

Says Kazuto Suzuki, a professor of Science and Technology Policy at Tokyo University, “The economy and security are very closely intertwined, and if Japan lets China buy or build advanced semiconductors, then what are the consequences for us?”

As industry experts and insiders watch developments closely, they are careful not to regard the Chip 4 Alliance as a magic bullet that will save the semiconductor industry. Nikkei Asia says that even with these semiconductor superpowers coming together, the smallest components of the semiconductor supply chain may disrupt the industry.

Self-sufficiency for each of these countries might not be what it’s expected to be. With China remaining almost an indispensable link in the supply chain, it becomes impossible to see what a semiconductor industry without China would be, and it would probably take more than just these four nations to do that.

As one of the Top 25 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog