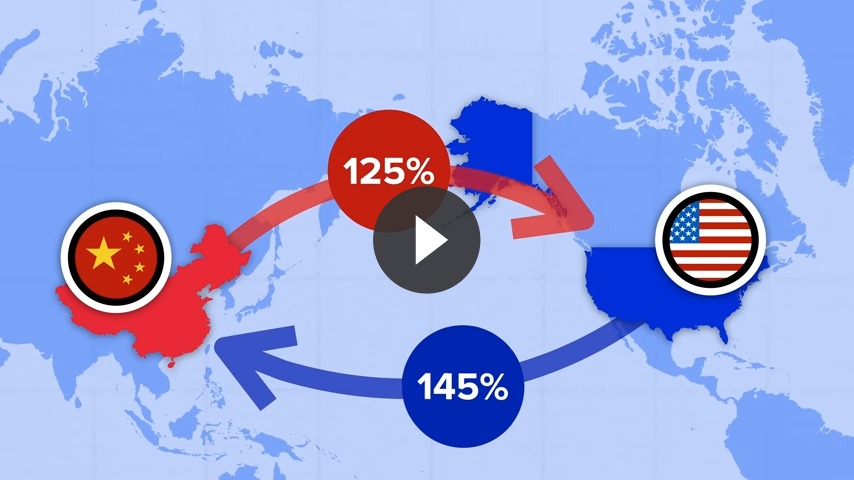

US–China Tariff Talks Learn What’s Changed

Both governments confirmed that the talks produced tangible outcomes, with officials on each side presenting the results as meaningful wins for their respective economies. The announcements were positioned as a stabilizing force for global commerce, particularly for firms focused on supply chain management that have struggled to plan amid months of shifting tariff policies and trade uncertainty.

(Also read: The Future of China’s Industrial Strength)

Wins for the US

According to the White House fact sheet, President Trump and Chinese President Xi Jinping secured a landmark trade and economic agreement that was framed as a major strategic win, reinforcing U.S. economic resilience, strengthening national security, and placing the needs of American workers, farmers, and households at the forefront.

-

Blocking the entry of fentanyl precursor chemicals into the US

China is committed to curbing fentanyl trafficking by tightening controls on the outsourcing and overseas shipment of designated chemical inputs, halting exports to North America, and imposing stricter global export oversight on other sensitive substances.

-

Removal of China’s existing and planned export restrictions on rare earths and other key minerals

China agreed to temporarily roll back a sweeping set of export restrictions on rare earths and other strategic minerals, effectively restoring broader access for U.S. end users and their global suppliers through newly issued general licenses.

The move pauses recently announced controls for up to a year and reverses many of the limits introduced since 2023, while Beijing also committed to tighter chemical export oversight linked to fentanyl supply chains.

In exchange, Washington will suspend a rule targeting firms with ownership ties deemed to pose security risks. Together, the steps were positioned as offering short-term relief to the U.S. automotive market, particularly for manufacturers scaling up electric vehicle (EV) production that depends heavily on these materials.

(Also read: A Deep Dive into China’s EV Empire)

-

Stepping back from retaliatory actions against U.S. chipmakers and other major companies

China will implement measures to restart trade from Nexperia’s Chinese facilities, ensuring the global supply of essential legacy chips and supporting the electronics manufacturing sector.

Nexperia is a Netherlands‑based global semiconductor maker that produces essential chips used across automotive, industrial, mobile, and consumer electronics. This commitment aims to restore the flow of critical legacy chips from Nexperia’s Chinese facilities to global markets.

-

Greater access for U.S. farmers as China reopens its market to soybeans and other agricultural exports

Beijing will buy at least 12 million metric tons of US soybeans in the final two months of 2025, followed by 25 million metric tons annually through 2028. The agreement also includes the resumption of US sorghum and hardwood log exports.

Analysts say the deal strengthens the economic value of US crops while reinforcing the country’s reputation for supplier quality in global markets. President Trump highlighted the arrangement, noting China’s commitment to “massive” purchases of agricultural products and initiating imports of American energy.

-

Suspension of retaliatory tariffs and trade restrictions

All retaliatory tariffs and trade restrictions imposed on the United States since March 2025 will be suspended, covering major agricultural products such as soybeans, corn, wheat, cotton, pork, beef, poultry, fruits, vegetables, dairy, and aquatic goods. Non-tariff measures, including the listing of certain American companies on end-user and unreliable entity lists, will also be lifted, reinforcing product validation and reliability for U.S. exporters.

Investigations targeting U.S. firms in the semiconductor supply chain, including antitrust, anti-monopoly, and anti-dumping probes, will be halted. Measures enacted in response to U.S. trade actions in the maritime, logistics, and shipbuilding sectors will likewise be removed, including sanctions on various shipping companies.

The market-based tariff exclusion process for U.S. imports will be extended through December 31, 2026, helping to smooth trade flows and reduce barriers for American exporters.

Wins for China

The agreement also includes measures that provide strategic benefits for China, reflecting gains on multiple fronts.

-

Reduction of tariffs on Chinese imports

As part of the deal, the US will reduce tariffs targeting Chinese imports linked to fentanyl trafficking from 20% to 10%, effective immediately. A representative from China’s Ministry of Commerce verified the cut and noted that the U.S. will also extend its suspension of reciprocal tariffs on Chinese goods for another year. The current 10% tariff will remain in place during this period, with the broader suspension lasting until November 10, 2026, providing stability for trade while addressing ongoing concerns over fentanyl supply chains.

-

Suspension of Section 301 measures on the maritime and logistics sectors

Section 301 actions targeting China’s maritime, logistics, and shipbuilding industries will be paused for one year, including related fees previously applied to China-linked ships at U.S. ports. In turn, China will halt its countermeasures for the same period, easing trade tensions and stabilizing global manufacturing markets. The suspension, starting November 10, 2025, allows negotiations under Section 301 to continue while the U.S. works with South Korea and Japan to strengthen and modernize its shipbuilding sector.

-

Suspension of the Expanded End‑User Controls Rule

The United States will pause for one year, beginning November 10, 2025, the implementation of the interim final rule known as the “Expansion of End‑User Controls to Cover Affiliates of Certain Listed Entities,” as a component of the wider export regulation system.

This regulation, issued by the Commerce Department’s Bureau of Industry and Security (BIS) in late September 2025, was designed to broaden U.S. export controls by extending restrictions to foreign affiliates that are 50% or more owned by companies already subject to export limits under the Entity List, Military End‑User List, or certain sanctions lists—closing a compliance gap under previous standards. Under the interim rule, such affiliates would face stringent license requirements and tighter scrutiny, aligning export controls more closely with long‑standing sanctions practices under a “50% Rule.”

Is the US really coming out ahead?

According to CNN, China’s trade landscape with the US has shifted dramatically during Trump’s second term. While exports to the US have declined sharply, falling to just 10% of China’s overall exports from more than 15% a year ago, the country’s broader industrial market remains resilient. In September alone, US-bound exports dropped 27%, yet China’s total exports still grew by over 6% as demand from other regions surged.

Key American commodities such as soybeans and beef have been replaced by suppliers in Argentina, Australia, and Brazil. Chinese firms are diversifying sourcing to secure alternatives, reflecting a future-ready approach to supply chain stability. Trade negotiations have led to new agreements, including multi-year soybean purchases, offering temporary relief to US producers.

Overall, while tariffs reshaped the US-China trade balance, China’s adaptive industrial market highlights its global agility. For the US, sustaining competitive advantages will require aligning strategy with a future-ready global marketplace. As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog