Philippine Chip Sector Gears up for a Breakthrough Era

The Philippines is carving out a stronger position in the global electronic manufacturing arena, as fresh investments and strategic reforms breathe new life into its semiconductor sector. With international demand surging and local manufacturing capabilities expanding, industry leaders say the country is on track to become a key player in advanced chip production and resilience in supply chain management.

Industry experts are taking note of the Philippines’ growing clout in semiconductor manufacturing. A recent highlight came as Integrated Micro-Electronics Inc. (IMI) clinched the coveted Gold Award for Best Managed Technology Company at FinanceAsia’s 29th Asia’s Best Companies Awards, underscoring the country’s rising reputation in the global manufacturing space.

IMI’s recent accolade reflects the confidence of top investors and analysts in its performance and leadership. Selected through a rigorous poll evaluating governance and growth, the award spotlights the company's global edge in delivering advanced engineering and manufacturing solutions and its commitment to innovation and long-term strategy.

Read more about IMI’s cutting-edge capabilities here.

Philippine semiconductor industry: progress and potential

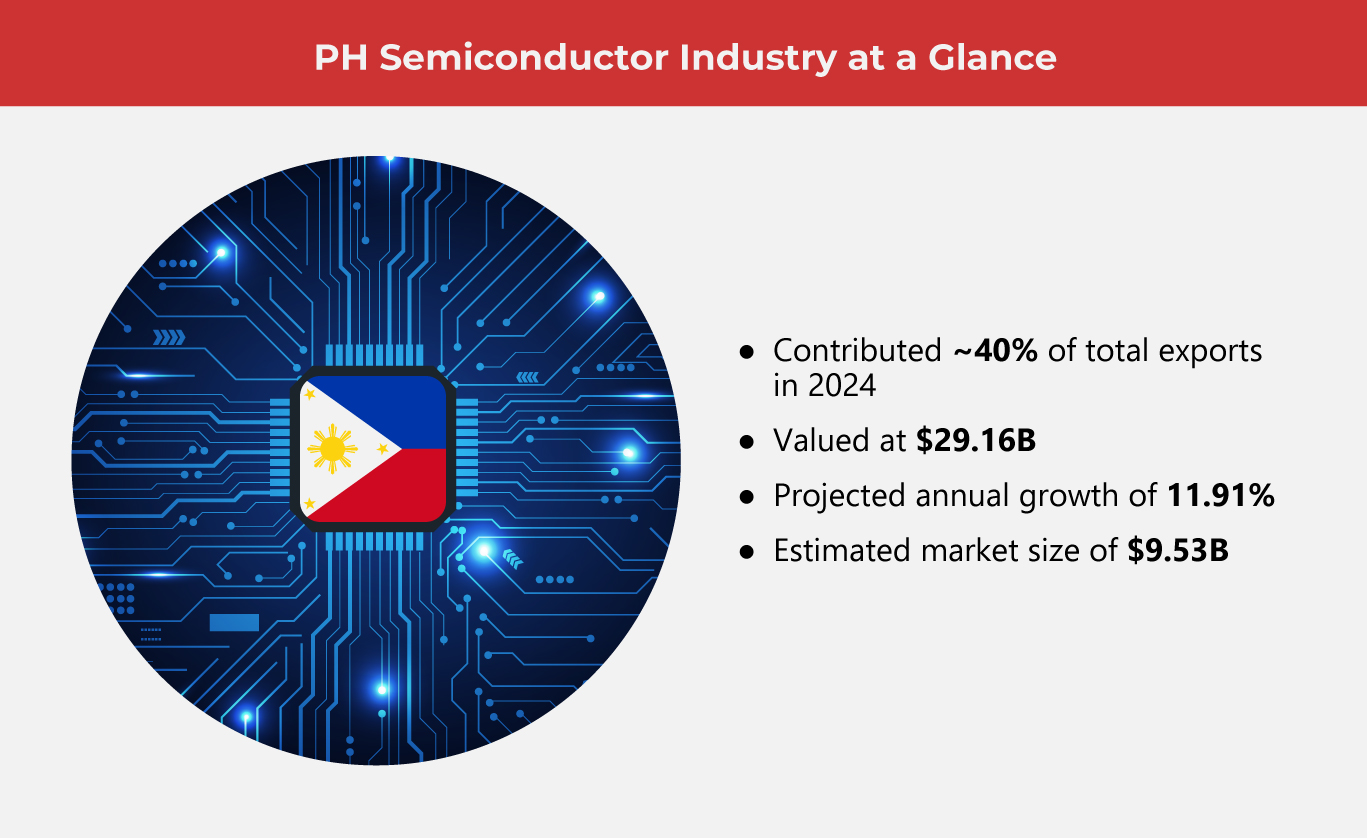

The semiconductor sector plays a vital role in sustaining the Philippines' trade performance, contributing significant economic value. In 2024 alone, exports of semiconductors and integrated circuits—components widely used in consumer electronics and mobile technology—accounted for almost 40% of the country’s total export value, reaching $29.16 billion. This underscores the country’s position as a top global chip supplier, ranking ninth worldwide.

The country holds a strong position in international manufacturing markets through its expertise in semiconductor assembly, testing, and packaging. This segment is projected to grow 11.91% annually through 2027, reaching a market value of $9.53 billion.

According to Rappler, the Philippines is home to major global players in the semiconductor and electronics space, from Texas Instruments to Panasonic and Samsung. These firms operate across various segments—from integrated device manufacturing to outsourced assembly, electronics manufacturing services (EMS), and original equipment manufacturing (OEM).

In today’s manufacturing industries, companies increasingly rely on outsourcing to stay competitive. Integrated device manufacturers (IDMs) manage the entire chip production process from research to fabrication, while fabless firms concentrate on design and leave the manufacturing to specialized partners. This division of labor supports faster innovation and operational efficiency.

Outsourcing also plays a central role through outsourced semiconductor assembly and test (OSAT) and EMS providers. OSAT companies handle chip packaging and testing after fabrication, allowing designers to avoid building costly infrastructure. EMS firms take charge of assembling and testing electronic products, enabling OEMs to focus on core design and business strategies.

According to market figures, the Philippines exports a broad spectrum of electronics, with semiconductors and data processing components topping the list. Local manufacturers produce microchips that power everything from consumer tech to national infrastructure. These chips play a vital role in system integration, ensuring smooth operations across digital devices and complex networks.

(Also read: IMI Joins Consumer Electronics Show 2025)

Market opportunities

Recently, the Philippines has seen a sharp rise in investments in its semiconductor and electronics sector, spurred by the global push to diversify supply chains and reduce dependence on China.

Japanese firm Sumitomo Metal Mining (SMM) is one of the major players strengthening its footprint in the country. Already the main buyer of nickel from Nickel Asia Corporation (NKIL), SMM has increased control over local operations, acquiring full ownership of Coral Bay Nickel Corporation (CBNC) in January 2025. At CBNC, annual output includes around 24,000 tons of nickel and 2,500 tons of cobalt. These metals are essential ingredients in the production of lithium-ion batteries, which power the rapidly expanding electric vehicle market.

SMM also manufactures cathode materials for rechargeable batteries, which are gaining traction as the automotive market shifts toward electrification. These battery materials are already used by leading brands like Tesla and Toyota.

Although the Philippines entered silicon wafer manufacturing late, the country is now well-positioned in the emerging gallium arsenide wafer segment due to early infrastructure investment, including a facility launched in Laguna in 2023.

Adding to its momentum, global companies such as Samsung and General Electric are expanding their R&D and sourcing operations locally. With one of the lowest tariffs in Southeast Asia, the Philippines is becoming a future-ready hub for advanced electronics manufacturing.

Challenges ahead

The Philippines has long relied on electronics as a major export driver, but recent data suggests a gradual loss of momentum. Back in 2020, electronic products dominated Philippine exports, comprising as much as 58.2% of total shipments abroad. That figure has since declined, reflecting changes in global demand and trade dynamics.

In response, the government launched the Semiconductor and Electronics Industry Advisory Council in April 2025. This new body, composed of public and private sector representatives, is tasked with crafting strategic policies to strengthen the global standing of Philippine electronics. A key focus is boosting the country’s 5% share in the global semiconductor value chain and helping manufacturers transition toward higher-value, innovation-driven production.

Despite these efforts, short-term prospects remain uncertain. The Semiconductor and Electronics Industries in the Philippines (SEIPI) has projected flat export performance in 2025, citing weak global demand even before the impact of new U.S. trade tariffs.

Adding to the challenge is declining business confidence on the ground. Survey data from the Bangko Sentral ng Pilipinas shows manufacturers are less optimistic than in past years, dampened by seasonal drops in demand and rising costs of basic goods.

Powering up for global play

The Philippines is steadily laying the groundwork to emerge as a major force in the global semiconductor sector over the next five years. President Ferdinand Marcos Jr. recently described the industry as a promising avenue for national development, reflecting growing confidence in the country’s potential.

This outlook was echoed during a meeting of the Semiconductor and Electronics sub-working group (SubWG) held at the Board of Investments (BOI) headquarters in Makati. One of the upcoming international engagements for the Philippines is Semicon Europa, a leading industry expo taking place in Munich in November 2025. The event offers an opportunity to expand the country's reach into the European semiconductor market.

Workforce development also took center stage. Since 2023, local firm Xinyx Design has spearheaded programs to bridge the skills gap through national competitions and university outreach. A planned collaboration between Xinyx Design and the Technological University of the Philippines aims to encourage engineering students to pursue microelectronics as a field of study.

Efforts are underway to institutionalize broader support. The BOI is drafting a proposed executive order for the president that would prioritize the semiconductor sector and streamline project approvals. In parallel, education advocates are urging the Commission on Higher Education (CHED) to introduce more specialized degree programs, including Bachelor of Science in Microelectronics, to build a future-ready talent pool.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog