Image Sensors at Their Peak

CMOS (Complementary Metal–Oxide–Semiconductor) sensors capture light and convert it into digital images, making them essential in modern cameras. They use less power, process images quickly, and are compact and cost-efficient. These advantages drive their widespread use not only in consumer devices, but also in the automotive market, electronic manufacturing, and medical electronics.

At their core, image sensors play a vital role in camera design and technology by converting light into electrical signals that can be processed, viewed, or stored. These solid-state components are central to machine vision systems, and each year they continue to improve in size, resolution, speed, and low-light performance, enhancing overall imaging capabilities.

In today’s global manufacturing, image sensors are essential, enabling automated systems to conduct visual inspection and analysis while making decisions with precision. Unlike consumer devices, machine vision cameras are purpose-built for industrial markets and environments, featuring durable construction and advanced capabilities tailored to modern manufacturing.

Engineered for continuous 24/7 operation, they capture consistent, high-quality images and deliver them to vision systems for real-time processing and inspection.

(Also read: Enhancing Automotive Vision: IMI's Advanced Camera Manufacturing Capabilities)

A quick look at image sensor history

Three pioneers of digital imaging—Eric Fossum, Nobukazu Teranishi, and Albert Theuwissen—recently published a paper tracing nearly 60 years of image sensor development, from early experiments to modern camera vision technology.

They explain that capturing images has long been part of human culture, but solid-state sensors made it possible to convert light into electronic signals. In the 1960s, researchers delved into product development, resulting in semiconductor-based light detectors and the first active-pixel ideas.

A major breakthrough came in 1969 with a new product introduction— the CCD (charge-coupled device), which dominated digital cameras through the 1970s to 1990s. This was supported by milestones like frame-transfer (1971), interline-transfer (1973), and pinned photodiodes (1982). By 1990, CCDs were used in nearly all digital cameras, but they faced challenges in power, speed, integration, and manufacturing cost.

These limitations opened the door for a better solution. In the 1990s, attention shifted to CMOS sensors. Two main research paths emerged: single-chip systems that boast economic value and high-performance imaging for aerospace engineering, the latter driven by NASA’s Jet Propulsion Laboratory. Eric Fossum’s team developed the CMOS active-pixel sensor with intrapixel charge transfer, laying the foundation for future-ready designs.

Innovations such as microlenses and backside illumination helped CMOS overcome many of CCD’s weaknesses. Soon, CMOS surpassed CCD, thanks to lower power usage, faster readout, easier integration with electronics, and better scalability.

Throughout the 21st century, CMOS continued to advance with high-volume production of backside-illuminated sensors, smaller pixels, 3D stacking, and applications like pill cameras.

Today, CMOS is the dominant image sensor technology across devices. Research continues with developments like quanta image sensors and Single Photon Avalanche Diodes (SPAD), proving that image sensor innovation is still moving forward.

CCD vs. CMOS

CCD and CMOS both convert light into electrical signals, but their internal designs process those signals in different ways, which has influenced their performance, power efficiency, and overall adoption across industrial manufacturing solutions.

CCD sensors gather light in each pixel and move the accumulated charge across the chip to a single amplifier. This method produces very clean and consistent signals, but it demands more power and limits readout speed. In contrast, CMOS sensors integrate amplifiers within each pixel or column, allowing signals to be processed directly on the sensor. This design supports faster readout, lower power use, and easier integration with additional circuitry on the same chip.

These differences created clear performance gaps. CMOS quickly became known for speed, achieving higher frame rates, while CCD cameras were slower but offered excellent image quality. CCDs traditionally used global shutter and delivered low noise and good dynamic range, making them reliable but power-hungry and expensive to manufacture.

Meanwhile, early CMOS sensors struggled with noise and lower sensitivity and often used rolling shutter, which scanned each line one at a time. However, ongoing advances such as global shutter capability allowed CMOS to match and eventually surpass CCD in image quality.

Over time, other advantages helped CMOS pull ahead. It consumed far less power, supported very high frame rates, avoided smearing, and could integrate both analog and digital functions on a single chip for greater scalability.

As innovations resolved earlier drawbacks, industries began shifting away from CCD. Smartphones, digital cameras, automotive systems, and industrial imaging systems increasingly adopted CMOS as the more efficient and flexible solution. The transition became so widespread that Sony announced it will discontinue CCD production by 2026.

In the end, CCD played a crucial role in the early era of digital imaging, but CMOS evolved into the faster, more efficient, and more versatile technology, making it the dominant image sensor used today.

(Also read: Driving Precision Forward: IMI’s Award-Winning Stray Light Tester for Automotive Cameras)

Key trends in CMOS technology

The global CMOS image sensor market is entering a new phase of strong growth, with analysts projecting it will reach a value of $30 billion by 2030. According to Yole Group’s Status of the CMOS Image Sensor Industry 2025 report, demand is rebounding after a period of stagnation.

The market rose 6.4% in 2024 to $23.2 billion, a clear improvement compared to just 2.3% growth between 2022 and 2023. This renewed momentum is largely driven by recovering smartphone sales, which still account for more than 60% of total CMOS image sensor demand.

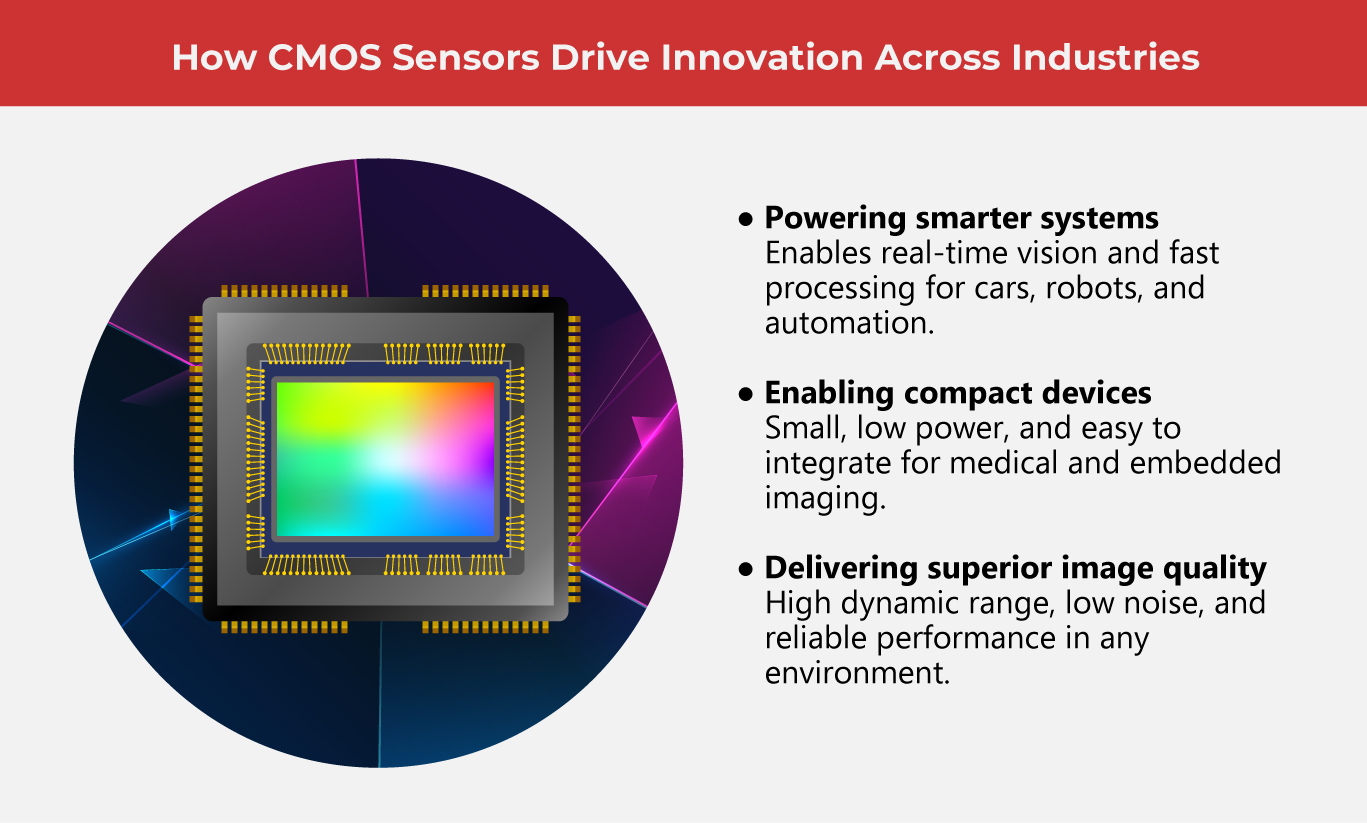

The automotive and security industries are also becoming increasingly important markets. In vehicles, the rapid adoption of advanced driver assistance systems (ADAS), in-cabin monitoring, and surround-view cameras is making imaging technology essential for safety and autonomy. Likewise, security and surveillance systems rely on CMOS sensors for high-resolution, low-light, and real-time imaging performance.

Yole expects this upward trend to extend into 2025 and beyond as these sectors continue to expand. The competitive landscape is also evolving. Sony remains the market leader, but Chinese manufacturers such as Omnivision, SmartSens, and Gpixel are steadily gaining market share.

Their rise is supported by two key advantages: the use of mature semiconductor nodes that are not affected by export controls, and hybrid manufacturing strategies that combine domestic and international foundry partnerships. For example, SmartSens collaborates with both TSMC and Samsung, enabling greater supply-chain stability, scalability, and flexibility to meet local demand in smartphones, surveillance, and automotive applications.

Yole’s data highlights this shift: manufacturers in Japan hold 48% of the market, followed by Korea at 21%, China at 19%, and Taiwan at 1%. As innovation accelerates and new use cases emerge, CMOS image sensors are set to play an even more important role across global industries.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready o support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog